Worldline SA (ENXTPA: WLN)

Ignore the "narratives" for ~30 minutes and look at the fundamentals (i.e., the data).

The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable. I post updates and thoughts more regularly on X (Twitter) at @PatchesAKF

September 23, 2024

[4/30/2025: See PatchesAKF April Update for update on my WLN holding.]

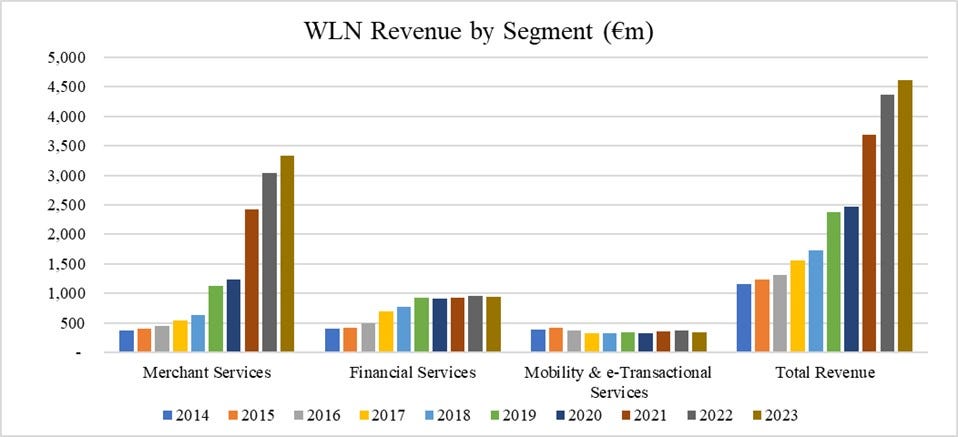

TLDR (and this post runs long…) Summary: Worldline is the largest payment service provider (PSP) in Europe and the 4th largest in the world (both by revenue). Merchant Services (MS) is ~73% of revenue and ~75% of adjusted EBITDA, Financial Services (FS) is ~20% and ~25%, and Mobility & e-Transactional Services (MTS) is ~7% and ~5%. To vastly oversimplify, MS earns a fee each time one of its ~1.4m merchant stores accepts a digital payment and FS earns a fee each time one of its ~126m payment cards is used and recurring fees based on contracted services.

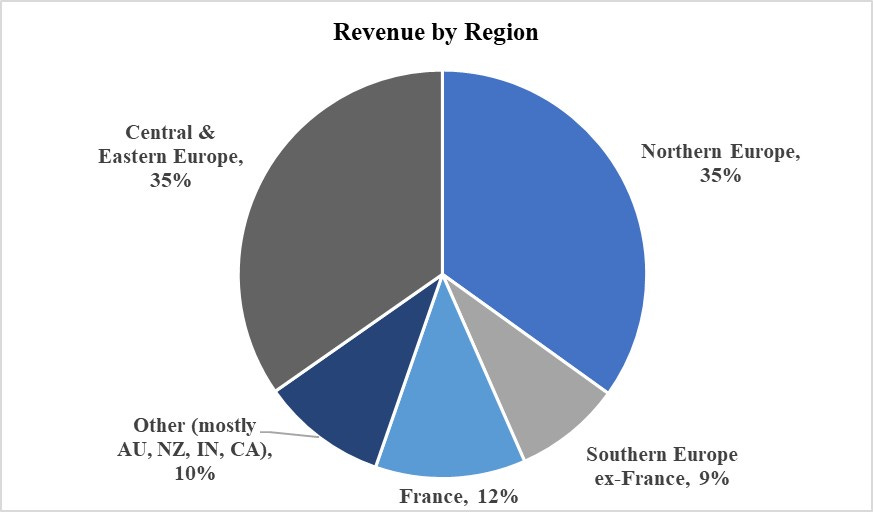

Payment services is a scale industry, with largely undifferentiated infrastructure that is expensive to build and support. Global scale is of utmost importance for payment processing (FS), but regional and national scale are the most important factors for merchant acquiring (MS). Scale translates into greater profit, which can be used to lower prices, improve services, or increase shareholder returns. WLN and Nexi are the largest PSP in Europe (by revenue), each supporting 15-20% of the merchants in Europe, followed by Global Payments (GPN) and Worldpay. Worldline is spread across the continent (no country is >25% of revenue), Nexi is concentrated in Italy (~60% of revenue), and GPN and Worldpay are both concentrated in the UK (est. >40% of revenue). WLN Europe revenue is >2x that of Nexi outside of Italy and 3-4x that of GPN and Worldpay in continental Europe.

Worldline’s core competency is supporting merchants with a physical presence; around 75% of MS revenue comes from transactions made in a store, with ~10pp of the other ~25% related to omnichannel transactions. Supporting hundreds of thousands of merchants with ~1.22m physical stores and ~190k online stores across 17 European countries requires significant local infrastructure. Worldline’s local scale, infrastructure and partnerships are a significant competitive advantage for supporting merchants with a physical presence. However, the company has been incredibly mismanaged over the last decade, primarily regarding M&A and investing in its offering and tech stack. Numerous governance changes in the last six months, including a new Chairman in June and the CEO resigning two weeks ago, create the potential for a significant improvement in management quality (having such a low bar helps!).

Worldline’s share price has fallen >75% in the past year. I discuss the potential reasons for the decline below. The shares trade at a ~12% 2024E FCF yield, which seems more likely to be a trough than a peak. The €200m FCF expected in 2024 will be the lowest outside of covid since 2018 (€194m), despite revenue and adjusted EBITDA nearly tripling and EBITA minus restructuring expenses (i.e., including these as ongoing expenses) more than doubling. The ~€270m restructuring expense in 2024E includes at least €133m for severance. Assuming this expense does not repeat going forward, FCF of €333m is a ~20% yield at the current market cap. (Only 12% of companies with a MCAP >$1.5b in the IBKR tradable universe1 (ex-banks and insurance companies) have a FCFE yield >10% and 2.5% of companies have a FCFE yield >20%.) From another angle, WLN trades for ~1.1x revenue and ~7.4x 2024E EBITA minus restructuring expenses (~5.9x EBITA adding back that severance charge). Mr. Market seems to expect earnings to shrink substantially going forward. WLN is by far the “cheapest” PSP in the developed world.

If the business is not structurally impaired, which I think there’s enough evidence to conclude, revenue and profit growth should accelerate with a recovery in Europe’s economy sometime in the next 1-3 years. When investor perception changes, it would not be unreasonable for the share price to exceed €30, with €45 possible under optimistic scenarios. In an extreme downside scenario where the business is irreparably impaired (see footnote2), the fundamentals are unlikely to just evaporate, because most MS revenue is from SMEs (who do not actively compare and change merchant acquirers) and most FS revenue is secured through long term (5-10 year) contracts. WLN also has options to support the valuation, such selling the non-core MTS segment and/or the preferred shares still held in the terminal business. At 6x to 8x average EBITDA, MTS would be worth €300m to €400m, which is 18-24% of the current market cap. The preferred shares are carried at €640m but selling them might require a 25% to 50% haircut, which at the midpoint is €400m and ~24% of the current market cap. Assuming both sales occur and 2024E FCF (adjusted to exclude MTS) plus the severance charge declines 10% per annum for the next 15 years and then ends, the intrinsic value of the shares is around €3. Therefore, the reward to risk ratio, especially when probability adjusted, is highly attractive.

Some combination of the following issues seems to be depressing Mr. Market:

The merchant terminations announced in October 2023

The potential implications of decelerating growth (i.e., competition)

Concerns about the tech stack and amount of “tech debt” (related to #2)

Low quality earnings

Low quality management and governance

There is truth to each issue, but setting aside the narratives and analyzing the fundamentals indicates WLN is not irreparably impaired and there is no reasonable justification for the current valuation.

Merchant terminations: In October 2023, WLN announced it would be terminating its relationship with a few thousand merchants over the subsequent 6 to 9 months. This decision was in response to an audit by Germany’s financial regulator, BaFin, which identified deficiencies in oversight of certain merchants by WLN’s JV in Germany. The merchants identified by BaFin accounted for ~€30m of revenue (0.65% of total revenue). Importantly, BaFin has audited every payment company in Germany over the last few years (since Wirecard). Nexi’s CEO noted at an investor conference shortly after WLN’s announcement that BaFin had identified merchants accounting for €20m to €25m of its revenue as being problematic a year or two earlier. Therefore, this was not a WLN-specific situation.

Worldline also decided to apply BaFin’s enhanced regulatory framework to its entire merchant portfolio. Merchants accounting for an additional ~€100m of revenue (2.2% of total revenue) were identified as problematic under the enhanced regulations. These were all online-only merchants acquired with Ingenico. WLN had terminated its relationship with these merchants by the end Q1 2024. Merchant terminations are an €85m to €90m revenue headwind in 2024 and a €50m to €60m EBITDA headwind. Since the announcement, there have been no unexpected developments regarding this situation. This does not appear to be a structural issue.

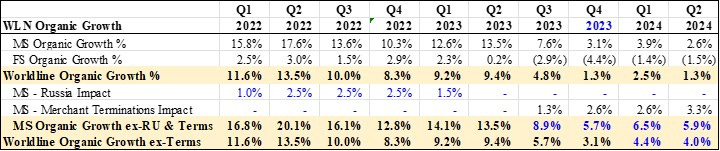

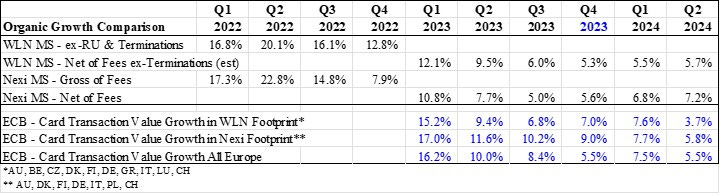

Growth deceleration: Over the last two years, organic growth has slowed from the low double digits to the low single digits. Merchant Services (~73% of revenue) is the key driver of organic growth, although Financial Services (~20%) has played a role in the growth deceleration as well. As shown in the table below, MS organic growth was a double digit percentage throughout 2022 despite an LSD percentage point headwind from discontinuing operations in Russia. Growth then decelerated sharply in Q3 2023, which management attributed to a Europe-wide economic slowdown. The merchant terminations mentioned above exacerbated the decline in growth, but even excluding the merchant terminations organic growth fell from 9.4% in Q2 2023 to 5.7% in Q3 and 3.1% in Q4.

Some investors have long believed that incumbent PSPs face an existential threat from new entrants (especially Adyen in Europe). The decline in WLN’s organic growth in 2023 and 2024 seems to have intensified this narrative. However, there is evidence that the deceleration was not WLN-specific:

Numerous companies have reported that European consumer spending has slowed and become more defensive over the last year.

Organic growth for Nexi’s Merchant Solutions (Nexi MS) segment also slowed throughout 2023.

The growth rate in card transaction value for WLN’s European footprint (based on ECB data) fell by more than half from Q1 to Q4 of 2023 and weakened sharply again in Q2 2024.

The last two points are shown in the table below. (WLN MS organic growth below is presented on a comparable basis to Nexi MS organic growth; the companies report revenue differently.) While Nexi MS organic growth has trended up since Q3 2023, it has faced easier comps compared to WLN MS. Italy’s card transaction value growth (50% of Nexi’s MS revenue) has also not slowed nearly as much as many other countries in Europe.

There is clear evidence that European consumer spending has slowed over the last several quarters. This does not mean that Worldline isn’t losing market share in certain merchant categories, such as online-only merchants (~15% of MS revenue). Adyen, whose core customers are multinational online-only merchants, could very well be taking market share (based on the relative growth rates). But this is not an existential threat. Worldline’s core competency is supporting merchants with a physical presence; around 75% of MS revenue comes from transactions made in a store. Supporting hundreds of thousands of merchants with ~1.22m physical stores and ~190k online stores across 17 European countries requires significant local infrastructure. Worldline’s local scale, infrastructure and partnerships are a significant competitive advantage for supporting merchants with a physical presence. Adyen could build this infrastructure over time, given its balance sheet and profitability, at the expense of margins, but it has shown no interest in pursuing this strategy. Moreover, payment services is not a winner-take-all or even winner-take-most industry. Over 50% of the European payments industry is still controlled by banks. While there is competition between PSPs, the biggest opportunity is taking market share from these banks. There is a long growth runway for all independent PSPs.

Finally, WLN MS is still growing (!) despite the merchant terminations, a weak European economy, and potentially losing market share. Based on the latest guidance, MS organic growth should exceed 2% in 2024 and 4.5% excluding the merchant terminations. FS growth should stabilize in mid/late 2025, after it cycles the current headwind, as most of the revenue is secured through long term contracts.

Tech Stack + Offering: As an outsider and generalist, it is difficult to compare offerings between PSPs, let alone the tech stacks supporting those offerings. Industry participants agree that WLN and Nexi charge merchants the lowest prices for acquiring services. Reports claim that the quality of the WLN MS offering and tech stack are below that of other acquirers. Considering that WLN is a roll-up of roll-up (i.e., it rolled up other roll-ups like Ingenico), these reports are most likely correct. Worldline has repeatedly stated that it is integrating the acquired IT platforms into a single platform, but it’s unclear where this integration stands or when it will be complete. There are three key questions about this topic:

At what point does the difference in offering and tech stack become more important than price to a merchant?

How close is Worldline to that point?

Can it close the gap in offering quality with a few years of targeted investment?

Worldline continues to add 5-6k merchant stores per month and grow total acquiring volume, so the gap in its offering quality must not be egregious. With 1.4m merchant stores – most of which are SMEs occupied with running their business rather than comparing acquirers – it’s unlikely that all its merchants leave overnight. Therefore, Worldline should have the time to improve its offering and tech stack if management prioritizes it. It is critical that internal investment is part of the next CEO’s plan, if for nothing else than to eliminate all doubt about the platform quality. One potential scenario is that the next CEO “kitchen sinks” near term free cash flow to upgrade the platform. This could mean short-term pain for significant long-term fundamental gain.

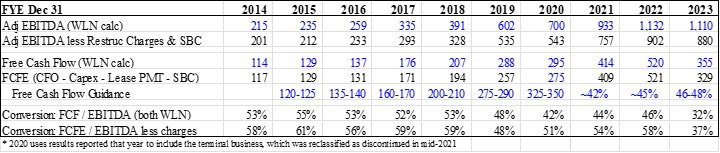

Low Quality Earnings: Worldline has a history of ongoing one-time charges, which management suggests investors ignore. However, one-time charges have occurred every year since 2013 and have increased nearly every year during that period as well. The chart below shows the history of restructuring and acquisition charges over the last decade. Management claims these charges will decline following the completion of the latest restructuring program, Power24, in early 2025. Power24, announced in October 2023, is mainly about reducing the bloat accumulated from a decade of acquisitions. A significant portion of the ~€250m implementation cost and the ~€220m in annual cost savings relate to layoffs. To prove its commitment to reducing one-time expenses, WLN recently changed variable compensation KPIs for its top 500 managers to emphasize reported EBITDA, instead of adjusted EBITDA, and FCF. Despite this change in incentives, it is not unreasonable to assume, until proven otherwise, that a portion of these charges are of a more permanent nature.

Notwithstanding the persistent one-time charges, WLN has consistently targeted and achieved a reasonable FCF to adjusted EBITDA conversion ratio. The table below shows adjusted EBITDA, adjusted EBITDA minus restructuring charges and stock based compensation, and FCF for the last decade. FCF conversion based on WLN’s figures has generally ranged from 45% to 55% excluding COVID and 2023. For comparison, Fiserv, perhaps the best managed PSP, targets an FCF to EBITDA conversion ratio of ~50%. Prior to 2023, WLN was generally able to grow FCF in line with adjusted earnings despite the rising one-time charges.

Low Quality Management: WLN’s management has been low quality for a long time: acquisitions have shown no price discipline, integration of acquired businesses has been slow and remains incomplete, WLN has probably underinvested in its product offering and tech stack, and no actions have been taken over the last year to create shareholder value while the shares trade at their lowest valuation ever. All of that said, there have been significant governance changes in the last few months, which could drive a significant improvement in management quality going forward. Specifically, the resignation of the longtime CEO (and Chairman prior to the Ingenico acquisition) indicates a new chapter for Worldline; the new Chairman has a history of returning capital to shareholders rather than spending on M&A; and compensation KPIs were recently adjusted to incentivize better earnings quality.

Company Overview (FYE Dec 31): Worldline was formed within Atos SE in the late 1990’s. Atos listed ~30% of Worldline in 2014 and distributed or sold the remainder of its stake over the next eight years (no longer a shareholder as of June 14, 2022). WLN has operations in >40 countries but generates ~90% of revenue in Europe.

Revenue was evenly split between the three segments (MS, FS, and MTS) prior to the Equens deal in 2016. Equens mainly added to FS. The acquisitions of SIX Payment Services (SPS) in 2018 and Ingenico in 2020 primarily contributed to MS. The graph below highlights revenue by segment over the last decade.

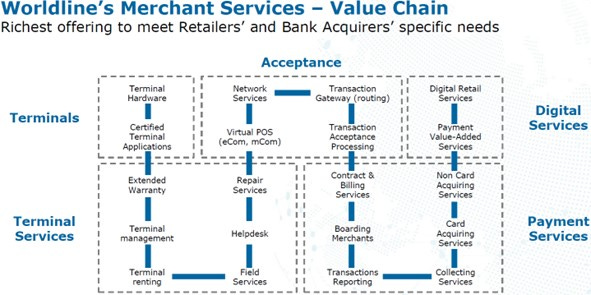

Merchant Services (~73% of revenue and ~75% of adjusted EBITDA): includes commercial acquiring, acceptance, and digital services. Simplistically, MS contracts merchants for payment acceptance, facilitates the acceptance of digital payments for those merchants, and transfers funds received during a transaction from the customer’s card issuing bank to the merchant’s bank account. It also provides merchants with an array of value-added services. WLN’s key services are in the acceptance and payment services sections of the image below. It is a one-stop-shop for European merchants of any size, supporting all types of payments, most currencies, all channels, and most geographical regions. MS revenue is 65-70% based on the value of transactions handled, 15-20% based on the volume of transactions handled, and 10-15% independent of transactions handled.

Financial Services (~20% and ~25%): includes issuing processing, acquiring processing, account payments, and digital banking. Simplistically, FS facilitates payments from the card issuing bank’s perspective. Issuing processing covers the entire value chain: management of card applications, onboarding new cardholders, card issuance (physical or virtual), transaction processing, payment authorization, fraud prevention and detection, clearing and settlement, and posting and reporting. Acquiring processing allows merchant acquirers to outsource part or all of their processing. Account payments cover back-office payments processing, clearing and settlement services, messaging and connectivity services, and liquidity management solutions for financial institutions. Worldline also helps financial institutions with digital customer engagement, including digital banking platforms, mobile banking platforms, and mobile wallets.

Mobility & e-Transactional Services (~7% and ~5%): includes transport and mobility, trusted services, and omnichannel interactions. It focuses on sectors – such as transport, health, government, etc. – that are moving from paper to digital and require secure transaction processing, regulatory compliance, and digital solutions. In late 2023, activist investor Bluebell Capital called for WLN to sell this business, as it’s not related to the other segments. MTS EBITDA has fluctuated around €50m for the last several years.

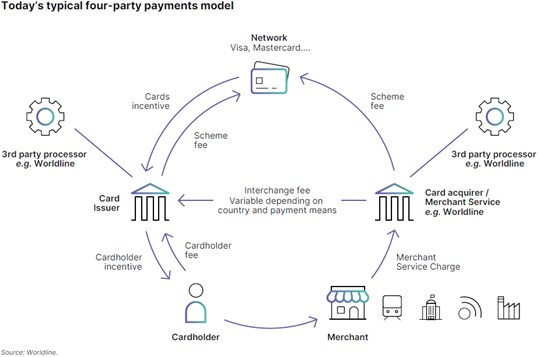

Industry & Business Model: A standard transaction network for a card payment is shown in the image below. Cardholders use cards issued by financial institutions to make payments, either in-store or online, to merchants. The process of issuing and managing cards and the process of authorizing, clearing, and settling payments is complex. Consequently, many financial institutions outsource part or all of these activities to third-party payment services providers (PSPs) like Worldline (Financial Services segment). The means of collecting and transmitting card data and receiving payment authorization (POS terminals or online payment gateways) are provided by merchant acquirers. Merchant acquirers also facilitate payment authorization via the scheme networks (e.g., Visa, Mastercard, etc.) and ensure transactions are cleared and settled into the merchant’s bank account. Many financial institutions outsource part or all of these activities to third-party PSPs like Worldline (Merchant Services segment). PSPs also provide a variety of other value-added services to both financial institutions and merchants, such as loyalty programs, fraud detection and prevention, digital wallets, data analytics, and much more. (The terms used to describe each participant in the value chain differs by company and region. I use merchant acquirer as a catch-all term for the services provided to merchants, and payment processor as a catch-all term for the services provided to card issuers. PSP is used as a catch-all term for all companies in one of these two groups.)

Payments is a scale industry, with largely undifferentiated infrastructure that is expensive to build and support. Global scale is of utmost importance for payment processing, as up to 80% of costs can be fixed at the global level. However, scale for merchant acquiring must be considered from a variety of scopes – the largest merchant acquirer in the US does not necessarily have a scale advantage in Germany. Global scale spread common costs (e.g., IT infrastructure, software development, cyber security, application of best practices, brand development, etc.) across more volume; national scale spreads country-specific costs (support for national network schemes, tax considerations, regulations, language capabilities, integration with national software providers, etc.) across more volume; and local scale spreads sales, services, and reliability costs (e.g., sales force, customer support, data centers, etc.) across more volume. Scale at each level translates into greater profit, which can be used to lower prices, improve services, or increase shareholder returns. Prices (bps charged) for basic processing and acquiring services have trended down over time while the range of services provided by PSPs has increased. These trends have generally offset each other in merchant acquiring, leading to stable take-rates for Europe’s largest players over the last few years. Take-rates for payment processing have trended down over time.

Merchant acquirers are typically paid a percentage of the transaction amount, sometimes called the merchant discount rate (MDR). The MDR includes most of the fees charged to the merchant, but most of the MDR does not stay with the merchant acquirer. Card issuers are paid a portion of the MDR known as the interchange fee and scheme networks are paid a portion known as the scheme fee. Other participants, such as the payment processor, also receive a portion of the MDR based on services provided for each transaction. All these fees are typically a percentage of the transaction amount. The MDR depends on a few key variables: size of the merchant, services provided to the merchant, payment method (debit vs. credit), and channel of the transaction (offline / online / hybrid).

New merchants are primarily added directly or through partnerships with local banks, depending on the size and sophistication of the merchant. Large merchants negotiate directly with merchant acquirers, while medium and small merchants are more likely to source a merchant acquirer through their primary bank. Since the latter group of merchants are less sophisticated (and have bigger things to worry about) than large merchants, the merchant acquirer recommended by the primary bank is typically the one chosen. An extensive sales force, operating in-person and over the phone, normally supplements distribution through the banking channel.

Processing relationships are established through contracts ranging from 5 to 10 years, with most renewed repeatedly. Integration is a multi-year process, with one expert explaining it as such: “It’s going to take you one year to do an evaluation. You’re going to be in implementation for one year. And then you’re going to be in cleanup for one year.” During the contract term, the payment processor continuously customizes the system to meet the specific needs of the bank. For these reasons, customer churn is low. However, contract renewals typically result in a ~20% price reduction for existing services. These price reductions are generally more than offset by an expansion of the volume and services covered under the new contract.

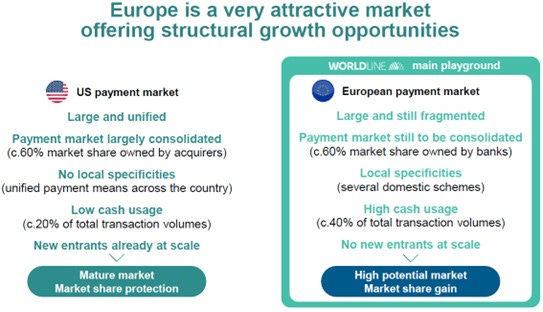

European Payments: The image below (from late 2021) highlights the attractiveness of the European payments market: it is large and fragmented, banks still represent most of the market, many countries have local specificities (network schemes, banks, taxes, regulations, currencies, languages, software providers, etc.) that make continental coverage complex, and a significant percentage of payments are still made with cash. Worldline and Nexi each support 15-20% of the merchants in Europe. These are the two largest pure-play PSPs in Europe, especially continental Europe (i.e., Europe ex-UK and Ireland).

Historically, European banks either offered payment services internally or through a JV with other local banks. However, multiple forces are now driving banks to outsource payment services to pure-play PSPs. To name a few of these forces:

Economies of scale allow pure-play PSPs to operate with lower costs and offer better products than a bank.

Regulations have reduced payment related revenue for banks (interchange) and increased payment related expenses (greater security and regulatory requirements), thereby raising the scale required to earn an adequate return.

PSPs must continuously invest to support an expanding range of payment options (NFC, BNPL, QR code, etc.) and network schemes (Visa, Mastercard, UnionPay, JCB, etc.) across channels and devices (offline / online / hybrid). These are fixed cost investments, meaning PSPs with scale are advantaged in developing and implementing each new capability.

Banks are seeing higher regulatory and IT costs across their entire business. With finite capital to invest, each operation faces increasing scrutiny as to whether it should be managed internally or through a partner. Considering the declining fees, required investment, and competition from pure-play PSPs, outsourcing payments is increasingly the wise decision for most banks.

European banks typically outsource payments by selling the business to a pure-play PSP (WLN, Nexi, FIS, etc.). The bank then signs a comprehensive long-term contract with the PSP: the bank exclusively promotes the PSP in exchange for lower prices and better services for its merchant customers. Purchasing the payment business of a local/national bank is the quickest way to build local/national scale, and it comes with significant synergy potential.

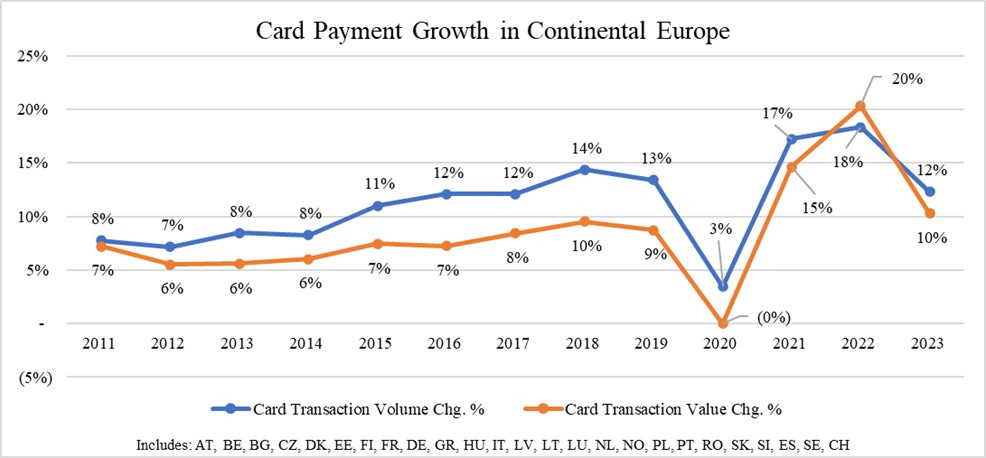

Industry growth is a function of nominal growth in consumption and the change in penetration of digital payments (vs. cash). The graph below shows the change in card transaction volume and value since 2011 for 25 European countries (source: ECB). The image after the graph shows the estimated penetration of payment by card (vs. cash) for various European regions in 2022. There remains a long runway for card payment penetration to increase across Europe. Considering this data and the high representation of banks in European payments, pure-play PSPs should be able to grow revenue at a high single digit percentage on average for the next several years (economic environment dependent). This outlook is in line with WLN and Nexi’s recently (2024 H1) stated medium-term organic growth targets. (Keep in mind that not all digital transactions have the same take-rate, so growth in card transaction value will not necessarily match growth in PSP revenue.)

WLN’s Competitive Position: Worldline is the largest merchant acquirer in Europe, but it is roughly equal in overall size to Nexi. The table below compares European revenue (on a LFL accounting basis3) for the largest PSPs in Europe: WLN, Nexi, Worldpay, GPN, Adyen, and FI. However, not every company specifically discloses revenue in Europe. Worldpay’s non-NA revenue and Fiserv’s international revenue both include Europe, Latin America and Asia. Using management commentary, I backed out Latin America from Fiserv’s international revenue, but the Fiserv revenue presented below still includes Asia.

Worldline and Nexi are by far the largest PSPs in Europe, especially continental Europe (i.e., ex-UK and Ireland). Nexi is highly concentrated in Italy (~60% of total revenue and ~50% of MS revenue), while Worldline is spread across the continent (no country is >25% of MS revenue) and deliberately has low exposure to the UK. The UK has lower barriers to entry, because there are fewer local complexities (e.g., no local schemes, same language as the US, etc.), and is therefore more competitive than countries in continental Europe. Worldline is the largest merchant acquirer, payment processor or both in Switzerland, Austria, Luxemburg, Belgium, Germany, France, and Greece, and it has a strong challenger position in the Nordics. Nexi is the leader in Italy and the Nordics.

Worldline is the largest merchant acquirer in Europe. Its MS revenue is ~20% greater than Nexi’s MS revenue and probably double the size of the #3 player. WLN’s relative scale in merchant acquiring is even greater in continental Europe outside of Italy, considering Nexi’s concentration in Italy (~50% of MS revenue) and the UK exposure for both Worldpay and GPN. To leverage its local scale and broad footprint, Worldline focuses on merchants with a physical presence, from small local merchants to large multinationals. It supports micro-merchants and online-only merchants, but these are not its bread-and-butter. WLN MS revenue is roughly 50% from SMEs, 35% from large merchants (including ~10pp from omnichannel), and 15% from online-only merchants. By comparison, Nexi MS revenue is roughly 60% from SMEs, 13% from large merchants, 10% from e-commerce, and 17% from ATM acquiring services.

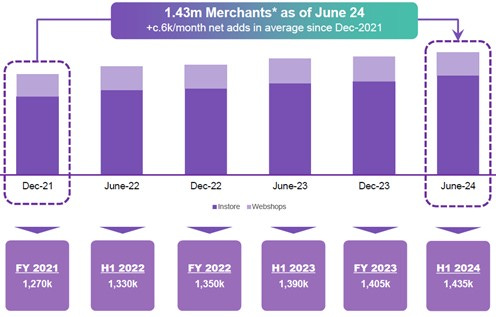

The image below shows the organic change in merchant stores supported by WLN over the last 2.5 years. Merchant stores have increased by 165k (~13%) since the end of 2021, with over 86% of the 1.4m stores supported at the end of 2023 being physical locations. Supporting over 1.2m physical locations across 17 European countries requires local infrastructure and local partnerships, which is a competitive advantage for WLN when competing for additional merchants. Evidencing its capabilities, WLN formed a strategic partnership with Credit Agricole in early 2023 to combine merchant acquiring operations in France. Merchant acquiring in France – the largest merchant acquiring market in Europe – was almost exclusively done by local banks (like Credit Agricole) prior to this deal. The JV, named CAWL, will be operational in early 2025. WLN believes CAWL’s revenue could reach €300m-€400m (~10% of MS gross revenue) in 4-5 years, with higher profitability than the current MS business because it will leverage existing infrastructure.

Nexi and Worldline are the largest payment processors in Europe by revenue and volume of transactions. Nexi manages ~140m payment cards and processes ~38b card transactions (issuing and acquiring combined) per annum. WLN manages ~126m payment cards and processes ~26b card transactions (issuing and acquiring combined) and ~23b account payment transactions per annum. As with MS, Nexi FS is heavily concentrated in Italy. Italy accounts for ~70% of Nexi FS revenue and ~50% of transaction volume. Nexi FS revenue is ~30% greater than WLN FS revenue, but it is ~60% smaller than WLN outside of Italy. Global Payments is a distant #3 for payment processing in Europe, especially continental Europe.

It is worth restating that >50% of the European payments industry is still controlled by banks. While there is competition between PSPs, the biggest opportunity is taking market share from these banks.

Other Competitors: A major narrative in payments is that newer entrants (who aren’t that new) will displace legacy PSPs such as Worldline, Nexi, Fiserv, Worldpay and GPN. The new entrants usually discussed are Adyen, Stripe (private), and Block (i.e., Square). I discuss Adyen in detail below, as it poses the greatest competitive threat to WLN out of these “new entrants.” Based on data I can find (subject to change if Stripe ever files a prospectus), Stripe primarily targets online-only merchants and is not a meaningful competitor in continental Europe (especially for merchants with a physical presence). Similarly, Block generates very little revenue in continental Europe and is not a meaningful competitor for Worldline.

Adyen was founded in 2006 and is based in the Netherlands. It is predominately a PSP for multinational online-only merchants, but its in-store volume is growing quickly. Examples of key clients are Spotify, Uber, Microsoft, Booking.com, Etsy, Groupon, McDonalds, easyJet, Levi’s, and Subway. Adyen wants to be a comprehensive payment platform for merchants. Two key aspects of Adyen’s offering are a single IT platform and an extensive licensing footprint. The former improves the user experience and maximizes innovation speed. To ensure everything remains on a single IT platform, Adyen has not done acquisitions – everything is built internally. An extensive licensing footprint allows Adyen to serve its core customers – multinational online-only merchants – all over the world with maximum processing speeds and authorization rates. The quality of Adyen’s offering has allowed it to continuously expand share of spend with customers; >80% of growth in each of the last five years was from existing customers (merchant growth + greater share of spend). Merchant churn by volume is very low (consistently less than 1%).

For the LTM from H1 2024, Adyen’s total global volume was ~€1.2t, of which ~€188b was in-store (i.e., through a POS terminal). Adyen’s in-store volume was ~€86b in 2021. For comparison, Nexi’s total volume is ~€840b and WLN’s is ~€1.5t (according to IR). Adyen’s net revenue of ~€1.8b is split 56% EMEA, 27% North America, 11% APAC, and 6% Latin America. POS volume is not disclosed by geographic region, but presumably it is not entirely in Europe. Unlike many fintech companies, Adyen is growing very rapidly and is very profitable. Net revenue has more than tripled since 2019 and volume is up nearly 5x. North America revenue is growing the fastest, but the largest euro growth has been in EMEA. Growth in the last two years has cost nearly 20pp of the EBITDA margin, although the margin remains very healthy in the mid-40% range. This level of profitability is a function of the business model: simple/focused tech stack, high volume global customers, and emphasize online-only merchants. (There are some accounting differences as well, but these are less meaningful than the business model.) The latter two points are also the reason Adyen is not an existential threat to WLN.

Worldline’s core competency is supporting merchants with a physical presence; around 75% of MS revenue comes from transactions made in stores, with ~10pp of the other 25% related to omnichannel transactions. Supporting hundreds of thousands of merchants with ~1.22m physical stores and ~190k online stores across 17 European countries requires significant local infrastructure and local partnerships. Adyen could build this infrastructure over time, given its balance sheet and profitability, at the expense of margins, but it has shown no interest in pursuing this strategy. It has instead emphasized that the real growth potential is in high-growth regions like the US, Brazil, and India. It is also worth restating that banks still control >50% of the European payments industry. Even if Adyen did change its focus toward physical merchants across Europe, competition is not always between PSPs. All of that said, Adyen is a threat to Worldline’s online-only merchants, which are ~15% of its MS revenue. Recent results from both companies indicate that WLN may be losing share in the online-only merchant category. Again, though, this is not an existential threat to Worldline.

[While I have done considerable research on Adyen, I still have more to do. If you believe there is an error in my analysis regarding Adyen, or anything else, please message me to point it out! I would appreciate it.]

Overall, I believe Worldline has a medium quality business model that has been severely mismanaged. If managed correctly, with the appropriate level of investment in its offering and tech stack to close the gap with regional competitors, WLN could have a medium-high quality business model. Its broad geographic footprint and regional + local scale are strong competitive advantages.

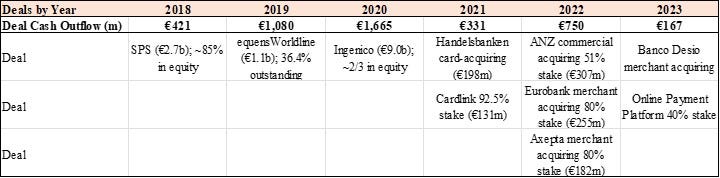

Capital Allocation + Management Quality: WLN is a roll-up of payment service providers (PSPs) across Europe. There are scale benefits in payments, and the European payment industry was highly fragmented a decade ago. WLN completed three sizeable deals – Equens (2016/2019), SIX Payment Services (2018), and Ingenico (2020) – and several smaller deals during the last decade. The table below lists the meaningful deals since 2018. SIX Payment Services (SPS) and Ingenico were the two largest acquisitions. These two acquisitions are discussed in detail in the footnotes.

WLN acquired SPS for ~€2.7b in 20184 (closed Nov 30) and Ingenico for ~€9.0b in 20205 (closed Oct 28). It used equity to pay for ~85% of the former and ~2/3 of the latter. WLN traded at ~19x LTM EBITDA the day before shares were issued for SPS and ~26x LTM EBITDA the day before shares were issued for Ingenico. I do not credit management intelligence for the use of richly valued shares to make these acquisitions. It is more probable that the companies being acquired wanted equity rather than a sign of brilliance by management. Equity has been a major component in all EU payment acquisitions of size (see Nexi’s M&A history as well). For WLN’s smaller deals with sufficient data, transactions are generally completed for a double digit (with a 1 handle) multiple of EBITDA.

Board, Chairman and CEO: WLN has 11 directors following the resignation of Gilles Grapinet (long time CEO). Two directors are representatives of SIX Group (11% shareholder), one represents Credit Agricole, a 7% shareholder and JV partner, one represents Bpifrance, a 5% shareholder, and one represents DSV Group, the JV partner for Payone. The other six directors are independent. Significant changes were made to the board at the AGM in June 2024: a new Chairman was elected, six directors resigned, two independent directors joined, and the Credit Agricole representative was elected. WLN’s previous Chairman passed away in December 2023. Board changes were at least partially due to pressure from activist investor Bluebell Capital and major (~8%) shareholder Harris Associates.

Wilfried Verstraete is the newly elected Chairman. He was previously CEO of credit insurer Euler Hermes (now Allianz Trade) for nearly twelve years. The rationale for choosing Verstraete was his “proven track record of deep transformation in complex industries within the financial sector…[he] managed to deeply transform [Euler Hermes] from a traditional trade credit insurer into a leading data-focused fintech…” During Verstraete’s tenure at Euler Hermes, the company allocated its €2.8b of cumulative CFO as such: €43m for acquisitions, €223m for share repurchases, €1,383m for dividends, and the rest to support the business. If this is a guide for future capital allocation priorities at WLN, emphasis will be on shareholder returns rather than acquisitions.

Gilles Grapinet joined Atos in 2008 and was appointed CEO and Chairman of Worldline in July 2013. He relinquished the Chairman title to Ingenico’s Chairman, Bernard Bourigeaud, with the acquisition of the Ingenico in late 2020. However, Bourigeaud was unable to serve as Chairman for personal reasons until late 2021, during which time Grapinet continued to perform the duties. (Bourigeaud founded Atos and served as its chairman until 2007. He passed away in December 2023.) Therefore, Grapinet led all the major capital allocation decisions.

Grapinet announced his resignation as CEO on September 13, 2024. This could symbolize the beginning of meaningful changes at Worldline. Worldline needs a CEO that is well versed in technological integration and organic investment, not a dealer. Company insiders have repeatedly stated on expert calls that Grapinet is not an operator.

WLN’s management has been low quality for a long time: acquisitions have shown no price discipline, integration of acquired businesses has been slow and remains incomplete, WLN has probably underinvested in its tech stack and product offering, and no actions have been taken over the last year to create shareholder value while the shares trade at their lowest valuation ever. All of that said, there have been significant governance changes in the last few months, which could drive a significant improvement in management quality going forward. Specifically, the resignation of the longtime CEO (and Chairman prior to the Ingenico acquisition) indicates a new chapter for Worldline; the new Chairman has a history of returning capital to shareholders rather than spending on M&A; and compensation KPIs were recently adjusted to incentivize better earnings quality (e.g., EBITDA instead of adjusted EBITDA).

Balance Sheet Quality (2024 H1): WLN has €2,150m in cash and cash equivalent and €3,813m in total debt (ex-lease liabilities), for net debt of €1.7b and net leverage of 1.7x LTM EBITDA (ex-lease related D&A). Debt includes straight bonds of €1.83b, convertible bonds of €1.38b (conversion >€100 per share), put options on non-controlling interests of €244m, and other financial liabilities of €355m. WLN has sufficient cash to pay all maturities in the next two years without additional FCF. WLN also refinanced its credit lines in July 2024 into a single €1.125b revolving credit facility that matures in July 2029. The balance sheet quality is medium-high. Existing leverage is appropriately termed out, and upcoming maturities can be met with current cash.

Maturity schedule: €1.0b in 2024, €770m in 2025, €1.0b in 2026, €531m in 2027, and €618m in 2028.

LT investments include €640m of preferred shares in Poseidon Bidco, the Apollo entity that acquired WLN’s terminal business in early 2022, €44m of Visa shares, and €38m of other financial assets.

Historical Financial History + Valuation: The table below highlights key financial metrics for Worldline. Guidance for 2024 was recently lowered to ~1.0% organic revenue growth, ~€1.1b of adjusted EBITDA, and ~€200m of FCF. The implications of guidance for H2 2024 are shown on the right side of the table.

MS Growth: Merchant terminations were an organic growth headwind in H2 2023 and throughout 2024. MS organic growth was 7.3% in H2 2023 excluding the merchant terminations and 6.2% in H1 2024. Merchant terminations will be a ~€35m revenue headwind in H2 2024, over 2pp for MS organic growth. Based on the latest guidance, MS organic growth excluding merchant terminations should be over 4.5% in 2024. While this would be the lowest organic growth rate for MS since 4% in 2018, it does not suggest a dying business. MS may be losing market share in certain merchant categories, like online-only merchants, but it is still growing both merchant stores and volume.

Also affecting MS organic growth is the slowdown in certain European economies over the last year, specifically Germany (~20% of MS revenue) and the Benelux region (15-20%). Inflationary pressures, high interest rates, and tight credit conditions have driven consumers to trade down and slowed consumption growth. Consumer softness can be seen in lower airfares (see Ryanair’s warnings throughout 2024), weakness in luxury goods, and the relative strength of defensive categories like groceries. (And all this commentary is supported by the ECB card transaction value growth rate falling by nearly 2/3 from Q2 2023 to Q2 2024.) While consumption is still growing, where consumption happens matters for merchant acquirers. A merchant acquirer has greater bargaining power, and can therefore charge a higher MDR, with smaller merchants (like restaurants) than with larger merchants (like discount grocery chains). A shift in dining from out-of-the-home to in-the-home can mean lower revenue for a merchant acquirer even if the same amount is spent on both meals. Moreover, most of this revenue decline falls to the merchant acquirer’s bottom line. The European economy has clearly been a headwind to revenue and profit growth since Q3 2023. (Again, though, this is not to say WLN is not having its own issues.) Whenever the European economic cycle turns the other way, MS should see a sharp recovery in revenue and profit growth.

FS Growth: Financial Services has faced a series of headwinds over the last few years. It had a major contract renewal at the end of 2021 and another at the end of 2022. Contracts renewals normally include a ~20% price reduction for the services being renewed. Revenue lost from the price reduction is typically more than offset by an expansion of volume and services with the new contract. Consequently, there is a significant growth headwind right after a contract is renewed and then a tailwind as the new volume and services are brought online. These headwinds are normally offset by growth in new business. However, WLN has failed to sign any big contracts in the last few years. Management has attributed this to a delay in outsourcing decisions by banks. WLN replaced the head of FS and the head of FS sales in early/mid 2023, and then replaced part of the sales team in the second half of 2023. These changes indicate there may be bigger issues within the division than just banks delaying outsourcing decisions. The new sales directive is to target banks of all sizes instead of just large banks. WLN claims the new business pipeline is steadily building, but these contracts take time to finalize and then implement. In the near term, any new business will be more than offset by the recent decision of a customer to insource its payment processing. This bank recently merged with a bank that did its payment processing internally, leading to the decision to insource the volume being outsourced to WLN. (It is rare for a bank to insource any payment service after deciding to outsource it. This is a unique case.) The insourcing will be a significant headwind through the first half of 2025. Consequently, FS revenue is expected to decline by a low single digit percentage in 2024, with a greater decline in H2 than in H1.

Something may be wrong “under the hood” at FS. Interestingly, though, only a small part of this segment is from Ingenico. Most of this segment was acquired before 2020 and was “fully integrated” by the end of 2022. It could be a matter of underinvestment or a lack of focus, as FS became a much smaller piece of the business after the Ingenico acquisition. Regardless, most of the business is secure due to the long contracts that customers sign. The next major contract is not up for renewal until 2029, according to IR. At worst the segment does not grow after the insourcing headwind is complete. At best, the new CEO reorganizes the division and restarts new business growth. Given the significant economies of scale and low churn rates in this business, FS could also be an attractive acquisition target for large global players. (I’m not sure if it makes sense to separate FS from MS, but it could provide a value enhancer to a strategic acquirer of WLN.)

MS Margin: The MS EBITDA margin is well below other merchant acquirers, both in Europe and the US. This is partially due to differences in accounting – WLN reports revenue gross of scheme fees and partner fees whereas other PSPs report revenue net of these fees. The MS EBITDA margin was 33% on a revenue net of fees basis for the LTM from H1 2024. For comparison, Nexi and Adyen have an MS EBITDA margin in the mid-to-high 40% range and FI, GPN, and Worldpay have an MS EBITDA margin of around 40%.

Worldline is probably not the most efficient operation, considering all the acquisitions it has made over the last several years. Inefficiency definitely accounts for some portion of the HSD+ percentage point margin gap with peers. The Power24 restructuring program is an effort to reduce fixed costs by shrinking a workforce that is bloated from a decade of acquisitions. Another factor is WLN’s broad footprint and relatively low revenue concentration by country (no country is >25% of revenue). To operate in most European countries requires local infrastructure – a blessing and a curse – which are largely fixed expenses. Margins are therefore a function of collective local scale; greater local scale leads to higher margins. To illustrate, Nexi’s high-40% MS EBITDA margin (on a LFL basis) is a function of its dominant position in Italy, which accounts for 50% of its MS revenue. Continuing to build local scale should significantly improve WLN’s margin over time. Revenue headwinds from merchant terminations and a weak European economy have offset any underlying growth (in merchant stores and volume) that WLN has seen over the last 12 to 18 months. These headwinds will eventually end or turn into a tailwind.

Absolute Valuation: Worldline trade at a ~12% 2024E FCF yield, which seems more likely to be a trough than a peak. The €200m FCF expected in 2024 will be the lowest outside of covid since 2018 (€194m), despite revenue and adjusted EBITDA nearly tripling and EBITA minus restructuring expenses (i.e., including these as ongoing expenses) more than doubling. The ~€270m restructuring expense in 2024E includes at least €133m for severance. Assuming this expense does not repeat going forward, FCF of €333m is a ~20% yield at the current market cap. From another angle, WLN trades for ~1.1x revenue and ~7.4x 2024E EBITA minus restructuring expenses (~5.9x EBITA adding back that severance charge). Mr. Market seems to expect earnings to shrink substantially going forward.

Relative Valuation & Transaction Multiples: Worldline is by far the “cheapest” PSP on a relative basis. The table below compares valuation metrics for six prominent PSPs (adjusting accounting to make financial metrics as comparable as possible). Historical transaction multiples for payment companies (16-22x EBITDA) also support the view that Worldline is materially undervalued. Granted, many of these transactions were during a period of industry consolidation and low interest rates. Cutting that multiple range in half still implies that WLN is drastically undervalued. From an EV / revenue perspective, none of the deals I can find were completed for less than 2.5x. A recent large transaction was the acquisition of a majority stake in Worldpay (early 2024). The transaction valued Worldpay at 3.6x-3.8x revenue and 9.8x-10.4x EBITDA, depending on whether a contingency payment is ultimately made. Worldpay was widely known to be struggling prior to the deal. It is hard to make a rational case for how WLN is currently being valued.

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write articles myself, expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.

Countries include US, CA, Mexico, Poland, Hong Kong, Japan, Singapore, Australia, and European Developed Markets. Total of 3,263 companies.

Meaning, it is not possible to improve the offering quality and tech stack regardless of the amount invested, and the business is destined to be wound down over some number of years.

WLN reports MS revenue gross of certain fees, while most other PSPs report this revenue net of those fees. WLN began disclosing revenue net of these fees in Q4 2023, and Nexi reported revenue gross of these fees prior to 2023. I do my best to compare revenue on an apples-to-apples basis below.

Six Payment Services Acquisition: SPS was owned by SIX Group, owner of the Swiss Stock Exchange and the Madrid Stock Exchange (BME). SIX Group is owned by a consortium of ~120 financial institutions and is now WLN’s largest shareholder (~11%). SPS was the 8th largest PSP in Europe, primarily operating in the DACH region. It was the largest acquirer in Switzerland, Austria, and Luxembourg, with #4 acquiring and #1 processing market share in Germany. Post deal, WLN was the largest PSP in Europe by revenue, with ~10% market share in acquiring (#1) and ~20% market share in payment processing (#1). In conjunction with the deal, the entire Swiss banking community signed a new 10-year contract with WLN FS.

SPS did ~€550m in revenue (>80% in MS) and ~€95m in EBITDA in 2018, implying an acquisition multiple of ~29x EBITDA. Synergies were expected to increase EBITDA by ~€110m by 2022. It is not unreasonable to believe that a company owned and operated by a consortium of ~120 financial institutions, many of which were also its customers, was not maximizing profit. Nearly 65% of the synergies related to improving IT efficiency, optimizing G&A, and optimizing the sales and customer support footprint. These are all “low hanging” opportunities in the payments industry. WLN claimed all synergies were delivered by the end of 2022. Achieving even half the targeted synergies obviously creates a much different valuation picture. Additionally, WLN’s use of its own richly valued shares to fund ~85% of the purchase means the valuation is not as high as the headline multiples suggest. (Assuming the intrinsic value of the issued WLN shares was 10x-12x EBITDA implies the acquisition multiple was 18x-20x 2018 EBITDA and 11x-13x EBITDA with 50% of the synergies).

Ingenico Acquisition: Acquiring Ingenico expanded WLN’s leadership position in Europe and made it the 4th largest PSP globally. Ingenico complimented and enhanced Worldline’s European footprint. Ingenico had ~€3.4b in revenue and ~€565m in EBITDA in 2019. Synergies were expected to increase EBITDA by €220m, with low hanging opportunities accounting for ~40% to ~60% of the total (my estimate). At face value, the transaction multiples of 16x 2019 EBITDA and 11.5x 2019 EBITDA plus synergies are reasonable, especially considering that WLN paid for 2/3 of the deal with its own shares trading at 26x EBITDA. However, Ingenico was a roll-up itself and POS terminals still accounted for ~40% of its revenue. The complexity of managing and integrating all the different systems that were acquired by both WLN and Ingenico over the span of a few years has undoubtedly caused significant issues.

Management decided to divest Ingenico’s terminal business (TSS) in 2021. However, the sale seems to have been rushed. Apollo agreed to pay €2.3b, reportedly a mid-single digit multiple of EBITDA, to acquire TSS in February 2022. The €2.3b consisted of €1.7b in cash and €0.6b of preferred shares in the new entity, Poseidon Bidco. Those preferred shares do not pay a dividend, and their ultimate value is dependent on Apollo’s eventual sale of Poseidon Bidco. (A cynical, some might say realistic, take on the preferred shares is that they will end up being worth less than €0.6b, meaning the price was even lower than reported.) Adjusting the Ingenico deal to reflect the sale of TSS, the transaction multiple ranges from very expensive (>26x EBITDA) to somewhat expense (>15x EBITDA) based on realized synergies. Again, though, WLN’s use of its own richly valued shares to fund ~2/3 of the purchase means the valuation is not as high as the headline multiples suggests.

Thanks for the thorough write up! We’ve been doing some work on WLN. Overall we like the business and industry and the valuation is very attractive.

A huge reservation we have is capital allocation which as you’ve detailed has been atrocious. From experience we’ve been burned from otherwise slam dunk investments by terrible capital allocation decisions. We are hopeful the new board and management are better or at least neutral capital allocators.

Stock down on results which missed slightly. New CEO in. Why is Merchant services not growing/projected to grow much ? What are the headwinds? Doesn't make sense.

Seems like a lot of the report today a wash to give the new CEO a fresh start