Update: Megacable Holdings (BMV: MEGA CPO)

"It’s not about earnings, it’s about wealth creation and levered cash-flow growth. Tell them you don’t care about earnings." - John Malone

The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable.

This is an update to my first post on Megacable from September 2021, which can be read here: Megacable link. A month after my first post, Megacable announced a massive network expansion program. It is now nearing the completion of that program and should see an explosion of free cash flow over the next few years.

August 5, 2024

There are four parts to this update:

Details of the network expansion

Financial performance since Q3 2021 and implications of 2027 targets

Valuation and Free Cash Flow

Short update on competitors

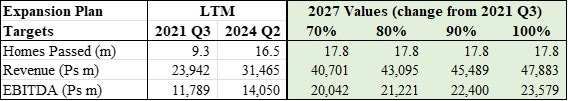

Details of the network expansion: In October 2021, a month after I published my first post, Megacable announced a massive network expansion program. Management planned to expand the network by 8m to 9m homes in 3-4 years (2024-2025) and double revenue and EBITDA by 2027. The table below shows each of these metrics as of Q3 2021 and Q2 2024. Achieving the networks expansion target is within Megacable control, and the expansion should be complete around the end of this year. Doubling revenue and EBITDA by 2027 requires cooperation from competitors and is therefore a less certain outcome. Consequently, the right side of the table shows a range of values for revenue and EBITDA based on a range of growth rates (70% to 100%) from Q3 2021. As discussed in greater detail below, the most probable outcome for 2027 seems to be ~80% revenue growth and ~70% EBITDA growth from Q3 2021.

The expansion was meant to be rapid, and management pledged to be selective about which territories were entered, wanting to earn an appropriate return on investment and not wanting to start a price war. The focus was underserved areas – where there were 0-1 fiber providers – that were adjacent to Megacable’s existing enterprise infrastructure. Almost three years later, Megacable’s mass market cable business has entered 55 new cities and is present in every state. The expansion will be largely complete by the end of this year, with a network passing ~17.8m homes. This implies Megacable’s network will pass ~50% of Mexico’s ~35m households. The chart below shows the quarterly progression of homes passed since Q3 2021. (About 90-95% of the incremental homes passed are in expansion territories, implying homes passed in legacy territories continued to increase by ~2.0% per annum.)

Expansion territories are entirely fiber-to-the-home (FTTH). This program coincided with a project to upgrade part of the legacy network to FTTH, as discussed in my first post. At the end of 2021, 18% of Megacable’s subscribers received their service through fiber. That figure was 71% in Q2 2024 and should continue to rise. About 50% of the legacy network is FTTH and the rest is HFC. Megacable plans to eventually upgrade the entire legacy network to fiber.

Financial performance since Q3 2021 and implications of 2027 targets: Revenue, EBITDA, Capex, and Leverage

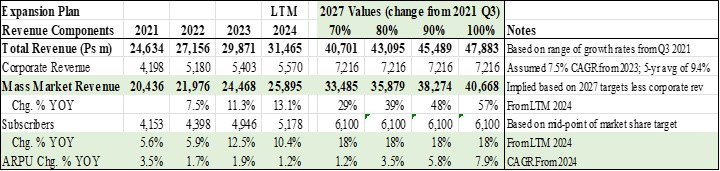

Revenue: The table below shows the change in revenue, subscribers, and ARPU since the expansion plan was announced. The middle section shows the implied 2027 revenue based on the range of growth rates that I mentioned above. Megacable’s network expansion is focused on the mass market, so I assume corporate revenue increases 7.5% per annum from 2023 to 2027, below the 5-year average of 9.4%, to get the implied mass market revenue for each scenario in 2027. Mass market revenue must increase ~29% from Q2 2024 to reach the low-end of the growth range, and ~57% to double pre-expansion revenue. Revenue is a function of subscribers and ARPU. I discuss each below.

Megacable believes it can achieve 20-25% subscriber market share in each expansion territory within 24 months of entering the area. Management noted at the end of 2023 that it had an average market share of ~13% across the new territories, with ~20% market share in some of the new territories. During the expansion, Megacable has maintained 43-44% market share in its legacy territories.

Subscribers have increased by ~1.1m (~26%) since Q3 2021, of which ~900k are in expansion territories. Management believes it can achieve the target market share (20-25%) in each new territory by the end of 2026. This implies incremental subscribers of at least 715k-1.1m over the next 30 months. Megacable would accordingly have 5.9m to 6.3m subscribers at the end of 2026, a 44-53% increase from Q3 2021 and a 14-21% increase from Q2 2024. At the midpoint of that range, ~18% of Mexican households would be Megacable subscribers. Achieving the midpoint does not seem unreasonable considering Megacable’s low prices (discussed below) and fiber offering (versus DSL or HFC offered in many expansion areas). For the same reasons, territories entered earlier in the expansion program could see market share exceed 20-25% over time. The table below uses the midpoint of the subscriber range to calculate the ARPU CAGR required for Megacable to achieve the various 2027 revenue scenarios.

Mass market ARPU has increased 1% to 2% per annum since 2021. Megacable raises prices semi-annually (typically in March and October), with the intention of at least matching inflation. However, price increases over the last two years were below inflation due to the level of inflation in Mexico and its effect on consumers. Additionally, strong subscriber growth in expansion territories, where ARPU is 30-40% below legacy territories, has weighed on consolidated ARPU. Megacable believes it can close this ARPU gap over time, especially after achieving its target market share in these territories. I estimate legacy territory ARPU increased ~3% in 2022, ~3% in 2023, and ~3% yoy in H1 2024. These growth rates are in line with pre-expansion ARPU growth, which averaged ~3%.

For Megacable to double pre-expansion revenue by 2027, ARPU needs to grow ~8% per annum for the next three years. Considering the historical growth rate, this seems like a very low probability scenario. (Megacable could double revenue with reasonable ARPU growth (2-3%) by achieving ~35% market share in the expansion territories. However, I also see this as a low probability scenario.) Achieving a 1.2% ARPU CAGR, and therefore 70% revenue growth from pre-expansion, seems like a reasonable worst case scenario considering the growth in ARPU over the last three years. A multi-year APRU CAGR above the historical rate of 3% is not unreasonable, considering the ARPU gap between legacy and expansion territories. However, Megacable’s subscriber growth is largely coming at the expense of competitors. Keeping new subscribers may constrain pricing growth for the next several years. Consequently, I believe the scenario of 80% revenue growth from pre-expansion, with a 3.5% ARPU CAGR, is the most likely outcome. (Again, these scenarios could be achieved through slightly higher market share in expansion territories and slightly lower ARPU growth.)

I believe the revenue scenarios detailed above have roughly the following probabilities of occurring: 10% for 70% growth, 77.5% for 80% growth, 10% for 90% growth, and 2.5% for 100% growth.

EBITDA: The consolidated EBITDA margin has fallen from 49-50% pre-expansion to ~44% in Q2 2024. Management has maintained that the EBITDA margin in legacy territories is in line with pre-expansion. The decline is obviously due to the network expansion and the low subscriber penetration in the new territories. According to management, the EBITDA margin in the expansion territories turned positive in Q3 2023, approached 20% in Q4 2023, and has improved since then. When the expansion is complete, certain operating expenses should decline and Megacable should see fixed cost leverage with subscriber growth in the new territories. Consequently, EBITDA growth should accelerate over the next few years and exceed both subscriber and revenue growth. Megacable believes the expansion territories can achieve a ~40% EBITDA margin with 20-25% market share. If it is successful in achieving a ~40% margin in expansion territories, the consolidated margin would still be below pre-expansion and total EBITDA growth would be below revenue growth. In the 80% revenue growth scenario, EBITDA growth would be ~70%. Given the lower market share in expansion territories, it is unlikely they will ever achieve the EBITDA margin of Megacable’s legacy territories. Flexing the mature margin for the expansion areas does not significantly change the 2027 EBITDA (a 1pp change in expansion area margins changes 2027 EBITDA by 0.5%). In line with my view that 80% revenue growth from pre-expansion is most the likely scenario, I also believe ~70% EBITDA growth is the most likely scenario. This scenario implies ~42% EBITDA growth from Q2 2024 to 2027.

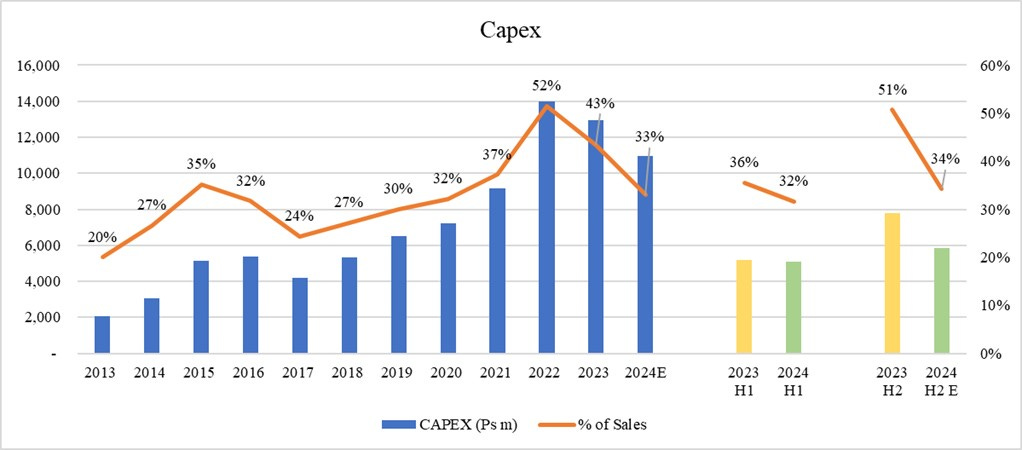

Capex: The speed of Megacable’s network expansion has been impressive. It was a massive investment. As shown in the chart below, capex nearly doubled from 2020 to 2022, when it reached ~52% of sales. Guidance is for capex to be 32-34% of sales in 2024 (~32% in H1) and then steadily decline to ~20% in 2027. The 2027 capex target includes ~5pp for growth investments, with maintenance capex cited as ~15% of sales.

Leverage: Megacable maintained a relatively conservative leverage ratio throughout the last few years despite the size of the expansion and continuing to pay a dividend equal to 20% of EBITDA each year. Net leverage is just ~1.5x LTM EBITDA (Q2 2024), which management says is the peak as internal cash flow can now fund the declining capex.

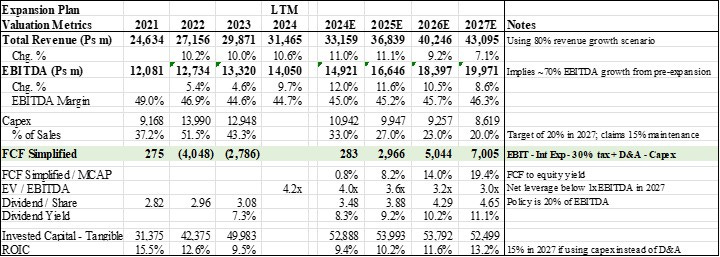

Valuation and Free Cash Flow: Megacable’s EV and MCAP are currently ~Ps60b and ~Ps36b, respectively. The image below shows the potential progression of Megacable’s financials through 2027 assuming it achieves the 80% revenue growth scenario described above. To highlight various points:

Capex to sales should fall from 32-34% in 2024 to ~20% in 2027.

FCF should expand to >Ps7b by 2027, which is a >19% equity yield at the current share price.

EV / EBITDA should decline from the current ~4.2x to ~3.0x in 2027, with net leverage below 1x EBITDA in 2027 including dividend payments.

Dividend per share should reach ~Ps4.65 by 2027, a >11% yield at the current share price.

ROIC should recover toward its historical level of a low-to-mid teen percentage, as the significant capital recently invested begins earning a return.

To keep the valuation discussion simplistic, I focus on an adequate FCF yield at maturity (i.e., in 2027). A 10% FCF yield seems, at worst, a reasonable valuation for an industry leader in Mexico with a durable competitive position, a good balance sheet, and a good management team. (A 10% FCF cap rate can thought of as a somewhat higher Ke less a LSD terminal growth rate.) A 10% FCF yield in 2027 implies an intrinsic value that is nearly double the current share price, which when considered with the annual dividend is a ~30% IRR. And if it takes longer for the share price to reach intrinsic value, the dividends will keep coming at a higher and higher yield (on the current price).

Short update on competitors I will keep this section brief and just provide high level commentary for Televisa (TV), Total Play (TP), and America Movil (AMX). After Megacable completes its expansion, there will not be any major expansion programs ongoing in Mexico. Megacable and TV both noted in 2024 that the pricing environment is improving relative to 2022 and 2023, although AMX has stated it does not intend to increase prices in the near term.

Televisa (cable business only): ended 2023 with a network passing 19.6m homes. It hired a new CEO, Francisco Valim, for the cable business in August 2023. He adjusted TV’s focus from expanding and upgrading the network and growing subscribers to emphasizing profitability and free cash flow. Accordingly, cable capex to sales declined from >30% every year prior to 2022 to 23% in 2023. Mass market cable revenue grew just 5% from 2021 to 2023, with average revenue per RGU falling ~1% over that period. Corporate cable revenue declined ~20% from 2021 to 2023. With the stagnation of revenue, TV’s cable EBITDA margin fell from ~42% in 2021 (and prior years) to 38.5% in 2023. Cable results were weak in the first half of 2024 as well (partially because of hurricane Otis in October 2023), with revenue falling 3% in H1 and the EBITDA margin declining 300bp yoy in Q1. TV began consolidating Sky (DTH satellite) with cable in Q2, so the margin deterioration is no longer visible.

Total Play: ended 2023 with a network passing 17.6m homes and 4.8m subscribers. Total Play aggressively built its network for several years (discussed my initial note), but the project was completed in Q1 2023. The network, which passes ~50% of Mexico’s households, overlaps with TV more than Megacable. TP’s mass market cable revenue growth slowed in 2023 to 13% and again in H1 2024 to 9%. Reported ARPU has stagnated over the last 18 months (calculated ARPU has declined 2%), but at a level 45% higher than Megacable’s reported ARPU in Q2 2024. Leverage was a concern for TP in early 2024, but it was able to refinance a substantial portion of its debt. Considering TP’s prices and network location, it should not be a meaningful threat to Megacable’s new fiber network.

America Movil: ended Q2 2024 with 11.0m broadband subscribers. AMX has aggressively upgraded its DSL network to fiber over the last few years, with 81% of subscriber connected with fiber at the end of 2023 compared to ~1/3 at the end of 2020. It has also kept broadband prices flat over the last few years to drive subscriber growth. After two years of no subscriber growth, AMX broadband subs in Mexico grew 4.6% in 2023 and another 4.5% in H1 2024 (from YE23). As a reminder, AMX cannot offer video services in Mexico because the regulator will not grant it the required license. Therefore, AMX only competes for double-play bundles. Over the long-term, AMX will be the most important competitor to monitor.

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.

https://www.telecompaper.com/news/ift-imposes-dominance-measures-on-megacable-in-5-states--1497303

What are your thoughts on regulatory actions against Megacable this year? Seems like the new President might have a similar (or perhaps even more enthusiastic) regulatory leaning ?