Pax Global Technologies (SEHK: 327)

International Growth at a Value Price

The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable.

August 31, 2021

Description: Pax Global Technology is one of the largest point of sale (POS) terminal producers in the world. It was spun out of Hi Sun Technology in 2010. Hi Sun is a Chinese VC fund that owns and operates a merchant acquiring business in China, among other businesses. The split with Hi Sun was to remove any conflict of interest for potential customers (many of which are merchant acquirers) as Pax expanded into international markets. Many merchant acquirers prefer to buy terminals from a pure-play supplier rather than a supplier that could also be a competitor. As Pax expanded internationally, it also began to deemphasize China, where the barriers to entry are low. China was 67% of sales in 2011 and less than 5% over the LTM ending June 30, 2021. The image below shows Pax’s revenue split by the geographic location of customers.

Products: POS terminals are devices that accept electronic payments from physical cards, NFC contactless cards (e.g., ApplePay) and QR codes (e.g., Alipay, WeChat Pay). Pax also develops unmanned payment terminals, such as for gas station pumps or McDonald’s self-service stations, and smart terminals.

Historically, Pax’s terminals used closed-loop operating systems that only processed payments. Over the last few years, however, Pax has invested heavily in developing smart terminals that use the Android operating system. Smart terminals can download and run applications, through an app store such as PAXSTORE, that allow them to provide more services for merchants than just payment processing. Pax offers its own software on these terminals, but it also allows independent developers to offer their own apps. Smart terminals can sync payment data with orders, inventory, accounting, and other business management systems. By providing services beyond payment processing, smart terminals increase the value provided to both Pax’s customers (merchant acquirers, banks, and some large merchants) and the end customers (merchants). This should increase customer stickiness and create additional revenue opportunities over time. Sale of Android terminals accounted for over 30% of Pax’s revenue in 2020 and over 35% in the first half of 2021. Terminals connected to the PAXSTORE platform rose from ~630k at the end of 2019 to nearly 2m at the end of 2020 to over 3m at the end of H1 2021.

Software revenue accounted for just HK$20m in H1 2021 (<1% of total), as Pax is providing most software for free today to build the user base, but should have a long runway for growth.

Production of Terminals: Pax has an asset-light production model, outsourcing the manufacturing and assembly of terminals to contractors in China. It then ships the assembled terminals to customers around the world. The only terminals not assembled in China are those sold in Brazil. In Brazil, to avoid import taxes, Pax sends the materials to its local distributor who assembles and sells the terminals. This distributor works exclusively for Pax.

Due to strong growth in demand over the last few years, Pax is outgrowing this asset-light model. It can no longer supply all its demand just using third-party contractors. Consequently, Pax announced in July 2021 that it will build a Smart Terminal Industrial Park in Guangdong Province, China, to expand overall production capacity and bring a portion of production in-house. Construction will be completed in Q4 2022, and production will begin in Q2 2023. Pax expects this new facility to expand annual production capacity from ~12m units to at least 22m units. Total capex for the project is expected to be around HK$500m.

Customers: are primarily distributors, merchant acquirers and financial institutions, but some large merchants also purchase directly from terminal producers. Customers (ex-merchants) are typically not exclusive. Pax’s distributor in Brazil accounted for ~39% of sales in 2020. However, that distributor sells to many of the merchant acquirers in Brazil, so it is not really a single customer. The image below highlights some of Pax’s largest customers by geographic region.

Brazil: two fast-growing new entrants, StoneCo and PagSeguro, both state in their regulatory filings that Pax supplies a “significant amount” of their POS terminals. Cielo also sources its terminals for SME merchants from Pax.

India: Pax entered the country in 2018 and is already the leading supplier of POS terminals. It has strong relationships with Paytm (backed by Alibaba, Softbank and Berkshire Hathaway) and Pine Labs. Both payment companies are expected to IPO soon, which could accelerate their growth and demand for terminals.

Europe: Pax is the exclusive supplier of POS terminals to Loomis AB in its new Loomis Pay initiative.

Pax prices and sells all terminals sold in emerging markets in US dollars to avoid currency risk.

Business Model Quality + Competitive Position: The image below shows the payment value chain and the transaction flow for electronic payments.

Barriers to Entry: Each payment terminal has two motherboards: one manages the security features and the other manages the operating system. To sell POS terminals, a producer needs to attain both global payment certifications and country-level payment certifications for its “security” motherboard. Achieving these certifications requires significant investment in R&D. The image below highlights the main certification requirements.

To be fair, essentially any terminal producer with scale could receive these certifications over time. For example, a large Chinese terminal producer could probably get the certifications required to enter any market. However, being certified does not guarantee sales or even equal consideration from customers. Remember, customers are usually not the end users (merchants). Acquirers and financial institutions buy the terminals and then sell them to the end users. The most important consideration for these customers is security. Can the terminal be hacked? Can the terminal provider be trusted with the payment data? For a new supplier to build a reputation for security, its products need to be used in a given market for a period of time. However, if there are no issues with existing suppliers, customers will not risk trying a new one and new suppliers will never get the chance to build a reputation. The global terminal market use to be a duopoly between Verifone and Ingenico. It took years for Pax to break into non-APAC markets in a meaningful way, and it was significantly aided by the emergence of two new merchant acquirers (i.e., StoneCo and PagSeguro in Brazil). These merchant acquirers needed a lower price point terminal for a class of merchants (micro-merchants and SME) that were not being served by existing acquirers. As Pax built its reputation and scale, it was able to win more business from established acquirers (e.g., Cielo) and large merchants (e.g., Disneyland). Pax built on this success by leading the transition to smart terminals, investing significantly more than peers over the last several years, and is now seeing strong growth in developed markets as a result. A new terminal provider becoming a meaningful global player would require time and opportunity – customers need a reason to try the new supplier.

After security, quality, capabilities, and price are the next three considerations for customers. Quality is important because downtime, either for replacement or for maintenance, potentially means lost sales for both the merchant and the merchant acquirer. Capabilities are a relatively new consideration with the introduction of smart terminals a few years ago. If security, quality, and capabilities are equal, price is the determining factor. Pax used to sell terminals at a 10-15% discount to Ingenico and Verifone, but today its prices are similar. Pax now focuses on providing terminals with industry leading capabilities, and it is leading the industry’s transition to smart terminals.

Market Size and Share: global POS terminal shipments were 128m in 2019, up nearly 3x from 43.5m in 2015. Most of that growth was, and 67% of annual shipments are, in APAC and primarily China. China is a very large (~33% of the global market) and unique market with low barriers to entry, partially due to the dominance of QR code payments. Terminal customers in China are focused more on price than on security, capabilities, or quality. Including China in the global terminal market distorts the actual international competitive picture, as discussed below.

Marketwatch estimates that the value of the global POS terminal market will increase at a 15% CAGR from 2019 to 2024.

(Industry shipment data is broken out by region not country, but the POS terminal installed base in APAC outside of China is low.) There are a few very large players – Newland Technologies shipped 14m units in 2018, Xinguodu shipped 7m units, Itron shipped 5.7m units and Anfu shipped 5.5m units – that operate primarily in China. Over 96% of units shipped by each of those four players in 2018 was in APAC. Because the Chinese market is so large, Newland had 13.8% global share in 2018 and Xinguodu had 7% global share. Excluding APAC, Newland had 1.9% share and Xinguodu had 0.2%.

Excluding Asia Pacific there are three major terminal producers. Pax Global had 19.2% global market share ex-APAC in 2019, Ingenico had 17.7% share and VeriFone had 15.2% share. There are three smaller players that each had mid-to-high single digit market share in 2018: BBPOS (8.6%), Castles Technology (6.1%), and Dspread (5.6%). The next largest players had ~3% or less share in 2018. Moreover, in each major region outside of APAC - US & Canada, EMEA, and Latin America - the four largest players accounted for 70% or more of shipments in 2018. (I only have global shipment data for 2019 for Pax, Ingenico, and Verifone.)

Verifone is owned by private equity and is strongest in the US. Both Ingenico and Pax claim Verifone has underinvested for several years. It has been losing market share as a result. Ingenico was acquired by Worldline in 2020 and is strongest in Europe. Ingenico’s terminal business was having growth issues in the few years prior to being acquired. It cited Pax as a reason for these issues, but the issues also followed its expansion into merchant acquiring. Pax believes Ingenico’s issues stem from the expansion into acquiring; many acquirers do not want to buy terminals from a competitor. Worldline is evaluating the strategic options for the newly acquired terminal business, which includes potentially selling it to private equity. Pax’s largest region is Latin America, but it has seen strong growth over the last two and a half years in both US & Canada and EMEA. BBPOS’s largest market is also Latin America. Castles Technology is a Taiwan-based producer, with a fairly even mix of shipments to all the major regions of the world.

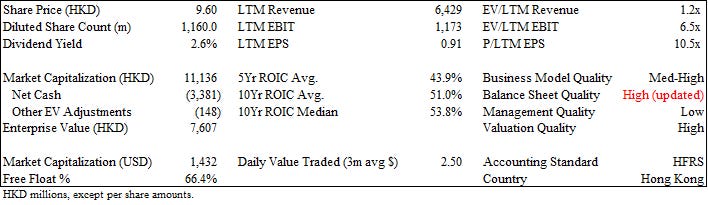

Business Model Quality: Pax has a strong and improving competitive position outside of APAC and in India. With three capable POS terminal providers, customers should have little incentive to support another entrant. It is possible for a new entrant to emerge, but it would take time for them to build a rapport with customers in each market and customers would need a reason to even provide that opportunity. Pax’s asset-light strategy and scale allow it to generate very strong returns on invested capital, averaging 44% over the last 5 years and 51% over the last 10 years. Moreover, Pax has invested heavily to ensure its products remain at the leading edge. The main negative aspect of Pax’s business model is that demand for POS terminals can be cyclical.

Historically, demand for POS terminals was based on a combination of increasing penetration and the replacement cycle. POS terminals have a replacement cycle of 3-5 years depending on geographic location. Replacement is driven by changes in security requirements (e.g., transition to EMV chip-enabled terminals), technological capabilities (e.g., ability to accept QR codes or NFC payment) and regular wear-and-tear. Smart terminals are now driving their own replacement cycle, as the value to merchant acquirers and merchants from upgrading to a smart terminal can more than justify the cost. Pax’s management believes we are in the early stage of this cycle.

Penetration: The simplest metric for penetration is POS terminals installed per capita. Terminal penetration for 2019 is shown in the image below (from BIS and Pax). These 28 countries had 97.7m installed terminals at the end of 2019, 36% of which were in China. While the appropriate number of terminals per capita is unknown, if we assume a mature amount is 30 then the current installed base in these 28 countries is only 2/3 to maturity. However, even the countries with the greatest terminal penetration report high cash usage, which could indicate penetration has room to increase. Terminal uses are also expanding, with additional use cases such as vending machines terminals, parking terminals, self-service fast food terminals, and individual restaurant table terminals gaining prevalence.

It is conceivable that one day technology renders POS terminals unnecessary, but this technology does not appear to exist yet. In fact, especially in emerging markets, demand for POS terminals is growing rapidly with the movement away from cash.

Overall, I view Pax’s business model quality as medium-high. My main concerns are cyclicality - after several strong years of growth are we capitalizing above mid-cycle demand? - and eventual technological disruption. I believe the latter concern is still many years down the road, given the dominance of credit cards and electronic wallets across the global economy.

Balance Sheet Quality [Updated]: There is HK$3.34b in net cash on the balance sheet, of which HK$2.2b is held in RMB. Having this much cash in China makes sense because most of Pax’s expenses – materials, assembly, R&D – are in China. According to IR, working capital fluctuations during the year can cause a short-term HK$500m use of cash. Pax keeps a portion of its cash in China to ensure it can meet all expenses. Additionally, the new production capacity is being built in China and will costs ~HK$500m.

Update: after feedback from a reader and additional consideration, I was overly negative on cash being held in China. Almost all expense occur in China, so the cash needs to be held locally. Moreover, almost all revenue is in USD, so the decision to bring cash back into China is a consistent consideration. If management wanted to hold more cash outside of China, it could do that at any point. Therefore, I’m upgrading my view of Pax’s balance sheet quality to high. [Old View: I view Pax’s balance sheet quality as medium. While hugely net cash, it’s unclear if Pax could or would distribute the cash in China to shareholders with China’s capital controls.]

Capital Allocation & Management Quality: Capital allocation has slowly improved since 2015 but remains lacking. Share repurchases totaled ~HK$50m in both 2016 and 2017 but then took a hiatus. Pax began repurchasing shares again in 2020, spending HK$78m to repurchase ~20.3m shares (1.9%) during the year. Buybacks slowed again in 2021, with just 2.4m shares repurchased through August. A small regular dividend was implemented in 2015 and then subsequently increased multiple times. The payout ratio for 2020, excluding a HK$0.10 per share special dividend, was 21% (33% including the special dividend). It increased to 25.5% in H1 2021. Total shareholder remuneration in 2020 is still small relative to the building cash balance, but it is an improvement from recent history.

With its rapid growth over the last decade, asset-light business model, and minimal shareholder returns, Pax’s balance sheet is extremely “inefficient” today. Management is taking steps to slowly improve returns to shareholders, but distributions are still a fraction of annual free cash flow. Consequently, the cash balance should continue to grow. While I do not believe management should “optimize” the leverage ratio, the existing capitalization is excessive and invites questions on the integrity of reporting (i.e., questions about fraud). These types of questions generally results in a lower-than-justified valuation. For these reasons I view Pax’s management quality as low.

Chairman and Management:

Guoming Nie is the Chairman. He joined Pax at its founding in March 2000 as the Vice President. He served as President from January 2001 until he was appointed Chairman in June 2010. He owns 4.2m Pax shares and received 1m share options in October 2019.

Jie Lu is the CEO and an executive director. He joined Pax in August 2001 and was appointed CEO in May 2013. He owns 8.87m Pax shares and received 11m share options in October 2019. Including the options, Mr. Lu owns ~1.8% of Pax’s shares outstanding.

Wenjin Li is an executive director of both Pax Global Technology and Hi Sun Technology. He joined Pax as an executive director in February 2010. He is responsible for Pax’s risk management and treasury management. He owns 2.9m Pax shares and received 11m share options in October 2019. Including the options, Mr. Li owns ~1.3% of Pax’s shares outstanding. Mr. Li also owns 6.4m shares of Hi Sun Technology, worth about HK$8.5m (significantly less than his stake in Pax even excluding the options).

Major Shareholders: Hi Sun owns ~33% of Pax, and there is one cross-board member, Li Wenjin (discussed above). There does not seem to be any concerning issues between these two entities.

Historical Financial Performance + Valuation Quality: revenue has grown 14.5% per annum over the last five years; accelerating over the last twelve months to 21.5% in H2 2020 and 30.6% in H1 2021. Management has guided for at least 25% growth in 2021, implying over 20% growth in the second half of the year. Adjusted operating margins (including impairments that Pax excludes) ranged from the high-teens to the low-20% range prior to 2017. Investments in R&D – developing the smart terminals and the PAXSTORE platform – and a change in geographic mix caused operating margins to fall to the mid-teens from 2017 to 2019. As smart terminals sales accelerated in 2020, gross margins improved and operating margins recovered to the high-teens. Management guidance is for an operating margin between 17% and 19% in 2021, with margin pressure coming from a shortage in semiconductor chips and the appreciation of the RMB. These headwinds should eventually subside. Pax operates an asset-light business model and return on invested capital averaged ~44% over the last five years and ~51% over the last 10 years. While the recently announced capex project will bring some production in-house and increase capital intensity, Pax’s ROIC should easily remain well above the cost of capital.

Pax currently trades at 11x LTM P/E and 6.5x LTM EBIT. Hypercom Corp, VeriFone, and Ingenico were all acquired for double digit multiples of EBITDA in the last decade. Pax may be an unlikely acquisition target, given the large ownership stake by Hi Sun, but there remains a massive valuation gap to private market transactions. From a justified multiple perspective, low- to mid-single digit growth and >40% ROIC could reasonably justify a 9-13x forward EBIT multiple. Based on management’s 2021 guidance, a reasonable intrinsic value range is therefore between HK$12.5 and HK$16.9. (The IV includes HK$2.9b of cash balance as HK$500m is operating cash for seasonal working capital.) Pax is currently trading at 23-43% discount to this intrinsic value range. I view Pax’s valuation quality as high, given the large discount to conservative estimates of intrinsic value.

Questions/concerns I’ve received for this post:

1. There is a question whether the numbers can be trusted:

# Inventory and receivable levels are high and much higher than competitors. Inventories + receivables + cash (most of which as you point out in China) are the entire balance sheet and larger than sales. Some businesses with similar characteristics have proven fraudulent historically

# Shareholder Hi-Sun has itself some shareholders with less than sterling reputations (Che Fung). And there are some folks who question on the legitimacy of that business as well which is why it trades at very large discount to the sum of the parts

# Macquarie analyst was famously kicked out of an analyst meeting by the CFO because he had a bearish take

# Cash balance is persistently high and company explanations why they need so much cash don't quite stack up

# Cash flow is pretty consistently < earnings. Totally the other way round for Ingenico et al

2. Earnings volatility, competitive positioning

# The two Brazilian customers account for almost all the profits

# Their experience in China has made investors weary of how easy it is for competitors to displace them

# Company did some acquisitions to expand in developed markets and those have been fairly unsuccessful

# They compete solely on price. The cost structure is perhaps a touch better than say Ingenico, but probably not significantly. Ingenico itself is a so so business, so Pax is structurally weaker

My answers to those follow-up points

Great points, thank you for sharing your notes! I agree that your points (especially #1) are why the stock is cheap, but I think that's the opportunity. After digging into the business, I found that almost all those concerns can be explained. (Obviously just providing my thoughts on these topics and how I got comfortable with the investment.)

For companies in emerging markets, especially China/Hong Kong, an “obvious” valuation can lead some international investors to automatically assume fraud. Therefore, the most important concern is the validity of the business. Is Pax a fraud? There are two aspects to this question: 1) the actual operations and 2) the reported balance sheet.

Operationally, there is strong evidence the business is real. LACIS (Latin America and Commonwealth Independent States) is Pax’s largest geographic segment, accounting for ~46% of LTM revenue. Three of the largest players in Brazil cite Pax as a supplier. StoneCo and PagSeguro both state in their filings that Pax supplies a “significant amount” of their POS terminals. Cielo also reports that its terminals for SME merchants are from Pax. Disneyland has been a Pax customer for at least four years. Ingenico discusses Pax as its strongest competitor, especially in emerging markets. Nilson data supports Pax’s shipment claims from year-to-year. And finally, and anecdotally, I have been to dozens of stores in NYC that use Pax terminals, countless small businesses and gas stations in upstate NY that use Pax terminals, and at least three airports in the US (one in Florida and two in NY) that use Pax terminal. Given the security requirements for POS terminals, it seems unlikely that financial institutions, merchant acquirers, and large merchants would use terminals from an untrustworthy supplier.

From the outside, evaluating the reported balance sheet of any company is difficult. However, there are some positive indications with Pax. Pax’s financial statements and disclosure are clear and simple. There are no weird accounts. Using the current cash balance and backchecking the cash flow statement with the balance sheet results in a perfect match – the cash flow statement at least supports the cash on the balance sheet. The vast majority (~90%) of assets are cash, accounts receivable and inventory. Accounts receivable days and inventory days have fluctuated over the last decade, but generally stayed in a reasonable range or improved. There are also no growing liability accounts other than accounts payable, which has fluctuated within a reasonable range.

To clarify one point, the global market was a duopoly between Ingenico and Verifone before Pax started to make international headway. There are small regional/country-specific players, but none with a meaningful global presence outside of those three. Therefore, there is not a large sample size of “competitors” to compare Pax’s financials against. Moreover, Ingenico has not been a pure terminal provider for several years - it was diversifying upstream into payment gateways, merchant acquiring, and other payment VAS for several years before it was acquired by Worldline in 2020.

Inventory & AR vs. peers: First, there is a meaningful difference with Pax historically and Verifone and Ingenico. Sale of physical terminals were only a portion of revenue for the latter two, with services accounting for >40% of Verifone's revenue the year before it was taken private (2017). Pax's revenue has almost exclusively (>95%) come from terminal sales for most of its history, although that is now changing. Therefore, inventory to sales or cogs should naturally be much lower for Verifone and Ingenico. Second, with Pax's revenue from terminals growing significantly faster than the other two players (see first table below), it is a rational business decision to hold more inventory to meet upcoming demand. It is also reasonable for a new entrant to offer more lenient AR terms when trying to gain market share. As Pax has grown in size and increased its presence in developed markets, AR/revenue has declined to be more in line with Verifone and Ingenico (see second table below). Management has stated that terms for new customers are shorter than old customers, which will bring AR days down over time (as seen in the results). I expect inventory days to eventually follow a similar path. Covid and the shortage of raw materials are causing an opposite effect on inventory right now, however, as Pax stockpiles products to make sure it can meet upcoming demand.

Inventory + AR + cash greater than sales: I don't follow why this point is a concern. I understand comparing inventory and AR to sales, but I don't get why you would add cash. To reiterate one of the points in my write-up: almost all sales are outside China and either done in USD or EUR, while all the expenses are in China. Therefore, it makes sense that Pax would constantly be converting cash back into CNY. This is a choice, though, and not a function of capital controls by the Chinese government.

Hi Sun Technology: I agree with your point here in terms of Che Feng and the complexity of Hi Sun's corporate/operational structure. I've stayed away from Hi Sun for these reasons despite its apparent "cheapness." Based on the available information it does not seem that there are meaningful personnel overlaps between Hi Sun and Pax, but it is hard to know for sure.

Macquarie Analyst: yes, this happened in 2016 and the share price declined from ~HK$6 to <HK$3 over the next few years. However, that CFO resigned the week after the event (in 2016). Management and IR seem much more open to shareholders and shareholder criticism now.

Persistent Cash Balance: the main explanation (from the company) for the cash balance is that it's a conservatively run company. This is not ideal for the maximization of shareholder value, but it's not a sign that the company is fraudulent (look at nearly every company in Japan). Management capital allocation quality is low, but it is slowly improving (see rising dividend payout each year).

Low management capital allocation quality also relates to their acquisitions, which have been unsuccessful. Thankfully these were all small acquisitions (HK$-wise), therefore not destroying much value. There are not many opportunities for acquisition of size in the market today.

Cash flow being less than earnings is a natural phenomenon when a company is growing and has positive operating capital. Pax's top line has grown 15% per annum over the last five years and operating working capital is now ~20% of sales. Ingenico's operating working capital is roughly 0% of sales for the reasons discussed above (business differences (large merchant acquiring business), different mix within terminal business (greater services versus hardware mix), and different growth rate (low/no organic growth for Ingenico’s terminal business)). Pax's operating working capital as a percentage of sales has declined over the last few years as AR improved and should continue to decline as inventory improves, following the eventual resolution of covid and the supply chain issues the world is seeing.

Profit concentration: Historically, yes, Brazilian merchant acquirers (all of them, not just PagSeguro and StoneCo) accounted for a significant portion of Pax's revenue and profit. This has been changing over the last few years as revenue growth in other regions outstrips growth in LACIS (Latin America and Commonwealth Independent States). Growth outside of LACIS continued to significantly exceed growth in LACIS in H1 2021. Still, concentration of sales to one specific country (Brazil) is a risk.

Competitive Displacement and "they compete only on price": It is true that the market structure changed significantly and quickly in China, but China is the only market in which this happened. If competition is only about price, why aren't the Chinese players flooding the world with cheap terminals? Why was the global terminal market a duopoly between Ingenico and Verifone for years? Why has Pax only been able to slowly break into EMEA and USCA even with, historically, cheaper terminals? Pax's prices are now similar around the world to Ingenico's (per management) and it is still gaining share (growing faster) relative to Ingenico, how come? I think the narrative that competition is only about price and there are no barriers to entry is the single most important and misunderstood aspect of this business. I explain why this is not the case in my initial post.

Ingenico is a so-so business: this is an interesting comment considering it was acquired for 17x trailing EBITDA (14.6x forward). The acquisition multiple definitely incorporated the higher quality merchant acquiring business that Ingenico owned, but terminals were probably 40-50% of Ingenico's EBITDA in 2020 (most of the Banks & Buyers segment). Similarly, Verifone was acquired for 15x trailing EBITDA (11x forward). These multiples seem to imply the private market thinks these are pretty good businesses.

I understand some investors prefer to just pass on these investments but thinking through the above is how I got comfortable with the stated concerns.

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.