PatchesAKF: November Update

Portfolio activity and news: Edenred SE, Logista Holdings, Megacable Holdings, Nexi Group, NexTone Inc., PT Indocement

This blog has two objectives: 1) to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities, and 2) to formalize my thoughts and create a record that I can scrutinize and learn from over time. I share my thoughts on portfolio-related news more regularly on X (Twitter) at @PatchesAKF

Portfolio Holdings: Over 75% of my assets are typically invested in 5-7 core holdings that I expect to own for several years. The rest of my portfolio is in opportunities that I believe have attractive reward-to-risk ratios but are either shorter-term holdings, have some probability of significant impairment, or are a starter position in a company I’m still researching.

Core: Edenred SE, Logista Holdings, Megacable Holdings, Nexi Group, NexTone Inc, PT Indocement

Other: GreenTree Hospitality, PDD Holdings 2027 Call Options, three undisclosed positions.

Core Portfolio Activity: I sold my investment in Barry Callebaut, as the share price reached my estimate of intrinsic value. The share price increased >70% since my initial purchase in April, a much faster recovery than anticipated. Barry Callebaut remains on my watchlist, and I would be interested in investing again if the market value offers an attractive margin of safety.

Core Portfolio News: All core holdings reported earnings since my last update. Edenred also held an investor day to discuss its three-year plan, and there was significant news around changes in meal voucher regulations.

Edenred SE: To start, Edenred reported solid Q3 sales (a sales-only report). Operating revenue growth improved sequentially in every geographical region and payment category. Importantly, revenue from “Beyond” products continues to grow faster than core products, diversifying Edenred’s exposure to regulated meal vouchers. For the first three quarters of 2025, Benefits & Engagement operating revenue grew ~6%, Mobility grew ~14%, and Complimentary Solutions declined ~10%, for total operating revenue growth of ~6% YTD. Management confirmed guidance of at least 10% LFL EBITDA growth in 2025. Not bad for a company trading at ~9x forward P/E (including the regulatory changes discussed below)!

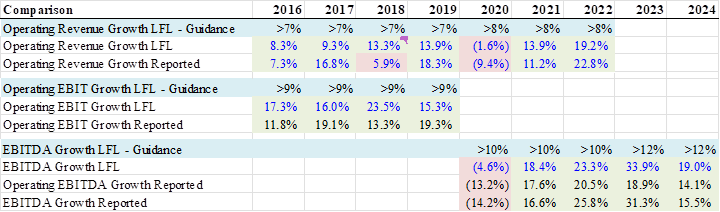

Edenred also held its investor day in early November, which provided a good overview of the business, competitive position, and outlook for the next few years. For those interested in Edenred, I recommend watching the presentation. The financial takeaways were that Edenred expects operating revenue growth in the high single digits from 2026 to 2028 and EBITDA LFL growth of 2% to 4% in 2026 and 8% to 12% in both 2027 and 2028. (These are before the regulatory changes discussed below.) Lower EBITDA growth in 2026 reflects the fee cap in Italy (~5pp impact to growth), exiting certain lower margin businesses (~1pp), lower float income (~1pp), and increased investment to support long-term growth. As a long-term shareholder, I fully support reinvesting to strengthen the competitive position and extend the duration of high operating revenue growth – just as I am supportive of the Rewards Gateway acquisition, which is starting to look prescient with all the recent regulatory changes – even if that means slower near-term EBITDA growth. Moreover, management has a strong history of outperforming guidance, and I wouldn’t be surprised if this guidance proves conservative as well (excluding regulatory changes). The table below compares historical guidance versus results. The only year this CEO (joined December 2015) has not achieved the multi-year targets was 2020, due to covid. Even then, Edenred still outperformed the 3-year CAGR targets for 2020 to 2022.

Finally, there have been numerous announcements on the regulatory front.

Face Value Changes: In 2025, 8 countries increased the maximum face value for meal vouchers. Belgium increased the maximum face value by 25% in 2026, Romania increased it by 12.5% in 2026, and Italy has proposed (but not finalized) a 25% increase in 2026. Four other countries are also considering increasing the maximum face value for meal vouchers in 2026. It typically takes 18-24 months for companies and users to increase their contribution after an increase in the regulated allowance. Therefore, these changes will support Edenred’s B&E operating revenue growth for the next few years, as previous increases support current growth. The increase by Italy is important to note, given the government made negative changes to the meal voucher system last year. This is a clear indication that there is no intention of ending the system that supports over 3.5m employees across the country.

Brazil: The President signed a decree making broad changes to the meal voucher system on November 11. These changes include capping the merchant take rate at 3.6%, reducing the repayment period to 15 days, forcing closed networks (all the large operators) to open their network to other players within 180 days, and requiring card machines from any provider to accept any meal vouchers regardless of the provider within 360 days (interoperability). There are some key aspects to these changes:

Payment providers are not allowed to charge merchants fees beyond the take rate. According to Edenred, its merchant take rate is only slightly above 4% in Brazil. However, it also charges service subscription fees and offers merchants accelerated payment of accounts receivable for a fee (a standard practice for card payments in Brazil). These additional fees are seemingly not allowed under the new system.

Closed network operators must allow other issuers and acquirers to use their network within 180 days. Edenred can charge other providers using its network a scheme fee per transaction, like Visa. However, this will be a much smaller fee than for closed-loop fees.

The interoperability law was first introduced in Brazil in 2022, but it was so technically/mechanically difficult to implement that it was delayed multiple times. It’s not clear that any of the difficulties have changed since the first law was passed.

The full details and implications of these changes are still being worked out (including by me). Edenred released a statement saying all meal voucher providers plan to take full legal action against the changes. However, it’s not clear there are legal grounds to dispute the changes (but I’m not an expert here). Management estimates the changes will reduce EBITDA in 2026 by ~13%, reducing guidance from +2-4% to -8-12%. This implies a negative revenue impact of ~€175m, which is ~75% of Edenred’s meal voucher operating revenue in Brazil and ~60% including my estimate of float income from Brazil. Edenred’s meal voucher business in Brazil is probably close to breakeven after these changes. As the third largest player with only slightly lower market share than Pluxee and Alelo, anyone smaller than Edenred will certainly not be profitable.

At the mid-point of Edenred’s updated guidance for 2026, I estimate it will still earn ~€2.09 per share in economic net income (ex-amortization and one-time charges). Meal vouchers should be around one-third of operating revenue next year.

There is a really important point to keep in mind regarding regulation changes in Brazil versus other countries. In Brazil, the meal voucher system is not a legislated tax benefit. The President has delegated powers to reform the market by decree, meaning he doesn’t need congress to approve the changes. This is NOT the case with other major country that issues meal vouchers: France, Italy, Belgium, Austria, Romania, Mexico, etc. The rules for meal vouchers are typically tied into tax, labor, or social security laws and require congressional or parliamentary approval to make changes. This means the bar for changes like those made in Brazil (fee caps, mandatory repayment periods, interoperability) is much higher and there is room for lobbying efforts by the meal voucher industry. Furthermore, keep in mind that these changes do not actually help employers or employees. It is purely a win for merchants.

France: The government has not passed the 2026 budget or finalized the announced regulatory changes for the meal voucher industry (requires a congressional vote). However, included in a recent version of the 2026 budget was an 8% tax on meal voucher contributions by employers. While I believe the effect of this tax would be minimal for Edenred, the government resoundingly rejected the proposal in early November, and it was removed from the budget bill (evidence of the point above). Interestingly, while Edenred’s share price fell >5% when the tax was announced, there was no recovery in the share price after the bill was rejected.

Turkey: In September, Turkey announced it would investigate all meal voucher providers for price fixing and other anticompetitive behaviors. Similar to other regulatory news, this isn’t positive, but it’s not a serious issue either. Turkey is a very low single digit percentage of revenue for Edenred, and this investigation should at worst result in a nominal fine.

Logista Holdings reported weak fiscal Q4 results due to the non-tobacco transportation businesses acquired over the last few years. General transportation is cyclical, and management noted the economic environment in Europe has been weak. Logista’s core business – tobacco distribution – continued its solid performance, with economic sales growing 4% in Iberia and 9% in Italy. France continues to shrink, as expected. Management expects adjusted EBITA to grow at a mid-single digit rate in FY26 excluding inventory valuation gains, compared to a ~5% decline in FY25. Logista confirmed it will pay a total dividend of €2.09 for FY25 (paid €0.56 earlier this year) and at least that much in FY26.

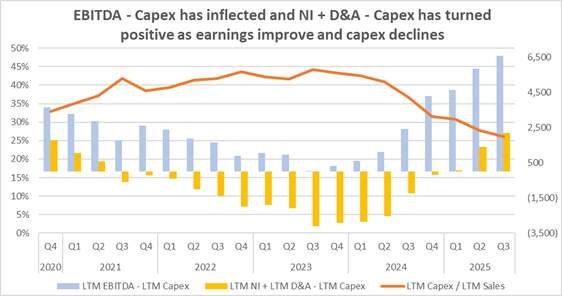

Megacable Holdings: reported solid Q3 results that showed continued strong growth in subscribers (+9% yoy; +2.1% qoq), particularly broadband subs (+10%; +2.3%), mass market revenue (+11%; +2.7%) and EBITDA (+10%; -0.2%). Importantly, capex continues to decline, both on an absolute basis and as a percentage of sales, driving free cash flow significantly higher (see chart below).

Net subscriber additions of +122k were slightly below the +129k in Q2. Management noted that both expansion territories and legacy territories saw positive net adds.

Churn increased slightly for each service both qoq and yoy as Megacable raised prices for the second time this year at the beginning of the quarter.

ARPU for unique subscribers increased both qoq and yoy (+1%). Consumers trading down to double-play bundles pressures ARPU, as does the continued growth in expansion territories, where entry rates are a significant discount to standard rates.

Total revenue growth was weighed down by a ~5% decline in corporate revenue. Management attributed this weakness to increased competition in the corporate sector. Corporate revenue is -5% YTD and ~1% above 2023 YTD.

Leverage decreased to 1.47x LTM EBITDA (ex-leases and estimated ROU depreciation), with net debt declining sequentially and EBITDA increasing.

Nexi Group reported okay results for Q3 with revenue growth in line with guidance, while EBITDA growth was weak (but still positive). Results were affected by previously disclosed bank consolidation in Italy, the effect of which will peak in Q4 and end in the second half of 2026. Management noted that revenue and EBITDA growth excluding these factors were several percentage points higher (5%-6%). Nexi confirmed that it expects LSD-MSD revenue growth, faster EBITDA growth (i.e., margin expansion), and at least €800m in FCF (17% of the MCAP!) in 2025. The impact from bank consolidation and contract renegotiations is expected to be lower in 2026 than 2025, implying revenue, EBITDA and FCF should grow at an accelerated pace next year (assuming a constant economic environment).

Nexi has €1.9b cash on hand compared to ~€6.8b in debt (ex-leases), for net leverage of ~2.6x.

The valuation continues to be ridiculously cheap: ~5x P/E, <6x EBITDA, and ~17% FCFE yield, while every earning or FCF metric is growing.

On November 7, Nexi confirmed it received a binding offer from TPG to buy certain assets in the DBS segment for €1.0b. Management is discussing the offer with the board and will decide by mid-December. This would be extremely positive for Nexi, given the current valuation. Assuming the assets to be acquired are ~80% of DBS EBITDA (7% of total EBITDA) implies an acquisition multiple of ~7.3x. Nexi trades at close to 5x EBITDA. The proceeds could be used to reduce leverage and increase shareholder returns (hopefully via additional share repurchases), setting the stage for significant shareholder returns in 2026 and/or 2027. If Nexi increases total shareholder returns by €100m for 2026 (as it did in 2025) and returns 50% of after-tax proceeds from the DBS sale, total shareholder returns in 2026 could be ~23% of the current market cap. This could take the form of a €350m dividend (~7% yield) and €730m of buybacks (>15% of the MCAP and >30% of the float).

NexTone Inc reported good absolute results for fiscal Q2, but they were below management’s targets. Revenue grew ~7%, driven by 12% growth in copyright management revenue, and EBITA grew ~67%. Management was targeting ~13% revenue growth and ~135% EBITA growth in Q2, but copyright management revenue did not grow as quickly as expected. NexTone continued to gain market share in copyright management.

PT Indocement reported weak results for the third quarter, reflecting the weak cement environment in Indonesia. Revenue is -3% YTD (-6% in Q3), EBITDA is -1.6% (-9% in Q3), and EPS is +4% (-6% in Q3). Net income has benefitted from the elimination of interest expense this year and a 2.9% reduction in shares from Q3 2024. Indocement spent IDR267b repurchasing 1.2% of shares in Q3. I expect this repurchase activity to continue for the rest of the year. The share price currently values INTP at an EV / ton of ~$43 (~$74 per ton when adjusted for current capacity utilization).

Information Worth Sharing:

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publicly update my thoughts and opinions.

I think the most likely explanation is something like the Panera Bread and Gavin Newsom thing in California. It's just cronyism. Aside from that most likely reason, perhaps keeping the money at the merchants who are local Brazilians is mostly better for their economy rather than having most of that fee go to a French public company. I don't know. But they aren't making merchants pass on the savings to customers. So that could be an explanation.

Any rational thoughts on why Pluxee believes this hurts them a lot less than Edenred?

thanks for sharing your thoughts. Interesting re EDEN: "The President has delegated powers to reform the market by decree, meaning he doesn’t need congress to approve the changes. This is NOT the case with other major country that issues meal vouchers: France, Italy, Belgium, Austria, Romania, Mexico, etc. The rules for meal vouchers are typically tied into tax, labor, or social security laws and require congressional or parliamentary approval to make changes."

The market seems to pricing in risk that these Brazil changes could have implications for Governing bodies in other markets. You bring up a good counterpoint here....