The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable.

September 28, 2021

Description: Megacable Holdings provides telecommunication services in Mexico, including video, broadband, voice, and mobile services. It is the second largest video provider and the third largest broadband provider in the country, with ~19% and ~16% national market share, respectively. By customer group, mass market cable accounted for 82% of 2020 revenue, corporate services accounted for 17.5%, and other accounted for 0.8%. Megacable is controlled by the Bours and Mazon families, which collectively own >50% of the shares outstanding. The CEO, Enrique Yamuni Robles, owns over 6% of the shares outstanding. The management team is not related to the controlling families.

Cable Business Model Summary: Telecom distribution is primarily a local scale business with capital and regulatory barriers to entry. Building a network requires significant upfront local investment (i.e., hundreds of millions of USD) and operating said network requires a concession from the national regulator. Cable is a high fixed cost (creating and maintaining the network) business. The marginal cost to add/support another subscriber within a network is relatively low. High market share and high household penetration in an area creates a high barrier to entry. New entrants need to lay out significant capital to build a network and then hope to take customers in an industry with moderate churn rates historically (can be a high single digit to mid-teen percentage annually). Moreover, cable providers with the highest local market share should be able to profitably offer the lowest prices. Given the barriers to entry, there are typically only a few cable providers in each geographic region. Price competition is rational in most markets. EBITDA margins are attractive (typically >30%) and relatively stable. Maintenance capex can be a low teen percentage of sales and initial capital invested acts as a tax shield – via depreciation – for future profits, resulting in steady-state free cash flow that significantly exceeds net income. However, growing telcos require a significant amount of cash. Given the benefits of local scale and the first mover advantages of building a network, telecom distribution is a highly acquisitive industry. Telcos typically use debt to fund growth and acquisitions and many sport leverage multiples in the mid-single digits. Competition for video services is typically between cable companies and direct-to-home (DTH) satellite companies. Competition for broadband services is typically between cable companies and local phone companies.

Technology and national industry structure for video and broadband in Mexico

Video (i.e., linear TV) is primarily provide through cables (both coaxial and optical fiber) and DTH satellites. Satellites were the dominant providers in Mexico for most of the last decade, with ~59% subscriber market share as recently as 2016. However, cable has gained share over the last several years, thanks to significant infrastructure investments, and now accounts for over 50% of national video subscribers. Due to the cost of building a cable network and the required subscriber density to earn an adequate return, satellites can be the best option for consumers in rural areas. Bundling video with high-speed broadband is the key advantage for cable over satellite. Satellite broadband technology is prohibitively slow, and bundles are uncommon for satellite subscribers in Mexico.

There were ~18.4m video subscribers in Mexico at the end of 2020, according to the IFT (Mexico’s telecom regulatory agency). National video subscribers are just 5% above the total at the end of 2015. Household penetration is around 50-60%. The four largest video providers accounted for nearly 99% of the market in 2020. Grupo Televisa had 11.6m video subscribers and ~63% market share (7.3m/40% share through Sky (DTH satellite) and 4.3m/23% share through cable). Megacable had 3.4m video subscribers and ~19% market share. Dish Mexico (DTH satellite) had 1.5m video subscribers and ~8% market share. And Total Play had 1.6m video subscribers and ~9% market share (Total Play is owned by Grupo Salinas). The table below show the historical market share for each of these companies.

Broadband (i.e., internet) is primarily provided via DSL (telephone line), coaxial cable, and optical fiber cable. Fiber is generally superior (i.e., bandwidth, speed, reliability, security, etc.) to coaxial which is superior to DSL. Coaxial can be upgraded (via DOCSIS 3.0 and DOCSIS 3.1) to provide a comparable service as fiber. To stream videos and music, email large files, or play video games online, cable broadband is recommended. Fiber networks are the most expensive to build and cost the most for consumers. The image below shows the speed differences between DSL, coaxial, and fiber (although speed is not the only consideration and fiber-level speed is not necessary for every consumer). The average broadband speed chosen by consumers in Mexico is 20-40 Mbps (according to both Televisa and Megacable). At the end of September 2020, ~30% of Mexican broadband subscribers used DSL, ~40% used coaxial, and ~29% used fiber. For reference, DSL accounted for ~54% of broadband subscribers in 2015, coaxial ~34%, and fiber ~10%.

There were ~22m broadband subscribers in Mexico at the end of 2020, according to the IFT. National broadband subscribers have increased 8.8% per annum over the last five years. Household penetration is around 60-65%, up from ~45% in 2015 but still well below developed countries (e.g., US is >90%). The four largest broadband providers accounted for ~99% of the market in 2020. America Movil had ~45% (~29% DSL and ~16% fiber), Televisa had ~27% (~24% cable and ~3% other), Megacable had ~16%, and Total Play had ~11%. The table below shows the historical market share for each of these companies.

Using only cable subscribers (i.e., ex-DSL and other), America Movil had ~24% market share, Televisa Cable had ~36% share, Megacable had ~23% share, and Total Play had ~16% share.

Since the end of 2015: Televisa has gained 640bp of market share, Megacable has gained 320bp, Total Play has gained 900bp, and America Movil has lost over 1500bp. These trends align with the changes in subscribers by technology: DSL subscribers have declined by 4% per annum (America Movil), coaxial cable subscribers have grown by 12% per annum, and optical fiber subscribers have grown 32% per annum. This trend should continue: DSL subscribers should continue to migrate to cable. The pace of change is dependent on the network expansion by each cable company.

Televisa’s cable network only passes, and can therefore only service, ~15.8m of the ~35.9m homes in Mexico. It increased homes passed by 3.6m from the end of 2015 to the end of 2020 (5.3% CAGR).

Megacable’s network only passes ~9.1m homes. It has increased ~3.6% per annum over the last 5 years, adding ~1.6m homes to the network.

Total Play’s network only passes ~10.5m homes but is growing the fastest, doubling homes passed over the last five years.

Megacable’s competitive position in Mexico’s cable market: Network, Subscribers, Market Share, Pricing, Churn

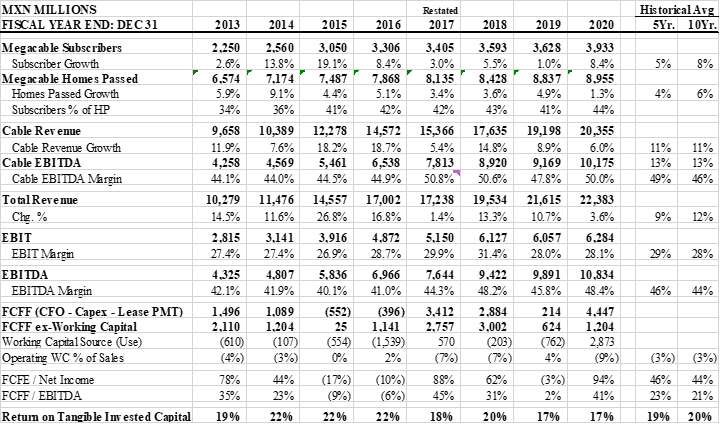

The table below shows the expansion of Megacable’s cable network, through growth in homes passed, since 2010. Homes passed has increased 3.6% per annum over the last five years. Growth slowed in 2020 as Megacable began upgrading part of the existing network with fiber-to-the-home (project discussed below). Homes passed should resume the historical mid-single-digit growth rate after the FTTH project is complete (expected to be in early 2022). Growth in subscribers is also shown in the table below. Subscriber growth exceeding growth in homes passed indicates Megacable is gaining market share within its network. The bottom of the table shows Megacable’s subscribers as a percentage of homes passed (i.e., its market share within its network). Megacable’s network market share has increased from ~35% a decade ago to ~44% in 2020. However, its market share of subscribers in the network is much higher given penetration is less than one. Megacable’s IR estimates video penetration within the network is ~60% and broadband penetration is 68-69%. Assuming these penetration rates are accurate, Megacable has ~64% video market share in its network and ~57% broadband market share.

The image below is to aid those unfamiliar with Mexico’s geography.

Megacable’s subscriber base is more dispersed than the other cable companies in Mexico (Grupo Televisa, America Movil, and Total Play). I use Megacable’s broadband subscribers as a proxy for all subscribers in the following analysis. No state accounts for more than 12% of Megacable’s subscribers and its four largest states – Jalisco, Sonora, Sinaloa, and Guanajuato – account for ~41% of total subscribers. Comparatively, the other three cable companies each have 20% of subscribers in a single state and their four largest states account for at least 50% of subscribers. Seven states account for between 8% and 12% of Megacable’s subscribers. Megacable has over 80% market share in three of those states, over 50% in two, 35% in one, and 15% in one. Nearly 60% of Megacable’s subscribers are in states where it has at least 50% subscriber market share. The tables below show the competitive landscape for Megacable’s largest states and the largest states in Mexico (although keep in mind that networks do not necessarily cover entire states; competition is local). These tables only consider cable subscribers (i.e., ex-DSL and other).

One reason for the disperse nature of Megacable’s subscriber base is that Megacable focuses on low to medium income areas. These tend to be less populous regions. Conversely, the other cable companies focus on higher income areas and generate a much higher ARPU. The most populous states in Mexico – State of Mexico, Mexico City, Veracruz, and Jalisco – are among the most competitive, with no cable company holding over 50% broadband market share in any of those states. Additionally, all four cable companies have a meaningful presence in each of those states except Mexico City, where Megacable does not have a mass market presence. (This is changing, however, as Megacable began offering mass market cable services in Mexico City in July 2021.) The attractiveness of the populous states for competition is evidenced by the location of Total Play’s broadband subscribers, 56% of which are in the four most populous states. As the latest entrant to the Mexican cable industry, it is telling where Total Play built its initial network.

According to management and IR, Megacable competes with Total Play in over 60% of its footprint and has for several years. However, only ~15% of Total Play’s subscribers are in Megacable’s direct territories. Megacable has clearly been gaining share within its network over the last several years (see above), and its subscriber churn has been declining (discussed below). There is no indication that Total Play’s entrance and expansion has negatively affected Megacable. This could be due to the difference in target customers and the resulting difference in pricing strategies.

Expanding into a market with an incumbent provider requires a significant capital outlay and then aggressive pricing to take subscribers, assuming similar service offerings. Higher prices by the incumbent provide more room for competition, all else equal, as an entrant needs to take fewer subscribers to earn an adequate return. Megacable’s industry low ARPU and industry high EBITDA margin make it very difficult for new entrants to compete in its markets. The table below compares the ARPU and EBITDA margin for the three cable companies with available data (AMX does not separate fiber broadband revenue from total broadband revenue). Megacable’s low prices and high EBITDA margin are functions of operational efficiency and high local market share (remember: nearly 60% of Megacable’s broadband subscribers are in states where it has at least 50% subscriber market share).

At the end of 2020, 44% of Megacable’s homes passed were subscribers, 40% of Televisa’s homes passed were subscribers, and 24% of Total Play’s homes passed were subscribers. Cable penetration in Megacable’s markets is generally lower than Televisa’s and Total Play’s markets, meaning Megacable’s market share of subscribers in its network is even higher than the other two companies.

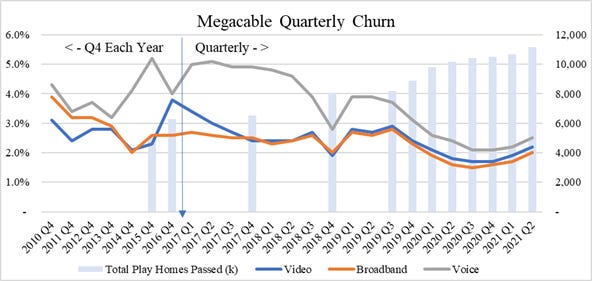

Megacable is the only Mexican cable company that has disclosed churn for a meaningful period. Therefore, we cannot evaluate its churn relative to peers. On an absolute basis, Megacable’s churn is low and has improved over the last 6-7 quarters. The chart below shows Megacable’s churn for each cable product. Video churn spiked in late 2016 when Megacable stopped carrying Televisa’s programming. It has since declined and remained below 2.5% for seven straight quarters. The chart also shows Total Play’s homes passed over the last several years, using the limited data available. Notably, Megacable’s churn has not risen with Total Play’s network expansion.

Broadband Network Technology: Megacable announced an investment project in November 2019 to upgrade 40-45% of its network to fiber-to-the-home (FTTH). The project covers Megacable’s 12 largest cities and will be completed in early 2022. Once complete, Megacable’s network in these cities will be equivalent to the best networks in Mexico. As FTTH is installed, Megacable is dismantling the existing hybrid fiber-coaxial (HFC) network in these cities. The dismantled equipment is being used to upgrade the rest of Megacable’s network by increasing the number of nodes. There are two consequences of this reinstallation strategy: 1) homes per node in the remaining HFC network will decline, improving service quality for each home, and 2) nodes, and therefore fiber, will be closer to more homes across the network. Regarding the first point: broadband service in an HFC network is dependent on the number of homes per node. All else equal, more homes per node equals lower service quality during busy periods (e.g., in the evening when more people are competing for bandwidth). Regarding the second point: the cost of upgrading the remaining HFC network to FTTH, if needed, will be greatly reduced because fiber is already closer to more homes. Moreover, bringing fiber closer to more homes makes Megacable an optimal partner for/provider of 5G, whenever it becomes a realistic option in Mexico. Additionally, the HFC portion of the network is deploying DOCSIS 3.1, meaning it also will be technically comparable to the best networks in Mexico. Finally, all greenfield network expansion will be FTTH.

Corporate Services: includes MetroCarrier (48% of corporate services revenue in 2020), MCM (28%), Ho1a (16%), and PCTV (8%). MetroCarrier is included with the cable business but does not serve the mass market.

MetroCarrier provides fiber-based telecom services to SMEs, large corporations, the public sector, and other carriers (i.e., wholesale services) across Mexico. The image below shows the coverage of MetroCarrier’s network. MetroCarrier’s revenue grew by a double-digit percentage every year prior to 2020 (grew ~2% in 2020). A big project was cancelled in 2020 due to covid, which would have driven double-digit growth for MetroCarrier during the year. Growth is expected to recover in 2021. Customers sign 3- to 5-year contracts with MetroCarrier and historical churn is lower than the mass market segment.

MCM provides fiber-based telecom services exclusively to the corporate sector. Its network is in the main business areas of Mexico City, Guadalajara, and Monterrey. MCM’s revenue has grown 12% per annum over the last five years.

Ho1a installs and integrates IT solutions (data centers, cloud services, cyber security, etc.) for corporations in cities across Mexico. Sales are all one-offs and project based, so results can be lumpy.

PCTV produces content for 5 owned TV channels. This is not a core operation for Megacable and there is no plan to make it a large business.

Enterprise Infrastructure as a Deterrent: In addition to the infrastructure for the mass market business, Megacable has fiber infrastructure (through MetroCarrier and MCM) in various cities servicing corporations and the public sector. Some of these cities are “off-net”, meaning Megacable has an enterprise business but no mass market business. Examples of Megacable’s historical off-net cities are Mexico City, Monterrey, and Cancun. Megacable has fiber infrastructure in these cities, but it historically has not offered cable services to the mass market. Mexico City and Monterrey are important markets for both Televisa and Total Play. According to Megacable, household income in these cities is the highest in the country. With its low-price model, high EBITDA margins, strong balance sheet, and existing fiber infrastructure, Megacable is extremely well positioned to enter the mass markets in both cities in response to competition in its own markets. In fact, in July 2021 Megacable began offering mass market services in parts of Mexico City, probably in response to Televisa’s expansion into Guadalajara this year (a Megacable market). Management stated on the Q1 and Q2 2021 conference calls that Megacable is considering entering more off-net markets. However, management also realizes that price wars are not good for anyone and does not want to compete unnecessarily. All decisions to expand the mass market business will be economically driven. Megacable will also continue to expand its infrastructure for corporate services in more cities, creating additional points of deterrent.

Other Business Model Considerations

Cord Cutting: Over the last several years, global linear TV has seen increased competition from OTT service providers (e.g., Netflix, Prime Video, Disney+, etc.). Some consumers are cutting video subscriptions and relying solely on internet-based streaming services. This phenomenon is not significant in Mexico today because cable prices are relatively low (see below), but it could eventually pressure the top line of video providers. On the other hand, cord cutting increases the competitive position of high-speed broadband providers, often the same company, and should drive broadband penetration. Cord cutting also leads to higher margins for cable companies because there are no programming costs in a bundle without video (Ps.65 per video subscriber for Megacable in 2020).

Evaluating the prices of different bundles from each cable company in Mexico, it appears that swapping linear TV for OTT services is not a cost saving move for most consumers. The table below shows the prices for various packages from the three cable companies that offer triple-play bundles (AMX cannot offer video services, as discussed below), using prices on each company’s website (from June 2021). The analysis is not about comparing prices between cable companies – Megacable has the lowest prices – it is about comparing prices of triple-play and double-play bundles. For packages with broadband speeds up to 100mbps, the price difference between bundles ranges from Ps100 to Ps210 per month ($5-10). Basic and standard subscriptions to Netflix in Mexico are Ps139 and Ps196 per month, respectively. Therefore, the price of linear TV is roughly equivalent to one OTT service.

America Movil (AMX): AMX is the legacy phone company in Mexico and a large portion (over 6m) of its fixed-line broadband subscribers are on its DSL network. It has an optical fiber network with ~3.6m broadband subscribers, but it has not been aggressively laying down new fiber in Mexico for years (Megacable’s IR estimates 5-7 years). Half of AMX’s fiber subscribers are in the three largest cities in Mexico: Mexico City, Monterrey, and Guadalajara. The rest are in high income cities around Mexico – typically capital cities of different states. Megacable believes AMX is not expanding its fiber network because of its status as a preponderate player. Regulation passed in 2013 requires preponderate players to allow all cable companies to access their infrastructure. The rate AMX can charge for this access is set by the regulators, not by AMX. Therefore, it does not make a lot of sense for AMX to build a fiber network all over the country just so other cable companies can use the infrastructure. [This is the rationale espoused by Megacable’s IR, so let us take it with a grain of salt. This is a topic I will monitor going forward.]

Additionally, the Mexican government has refused to grant AMX a video license due to its dominant market share in the broader telecom industry. AMX expects to eventually be granted a license, but it has expected this for many years. The case against it receiving a license weakens every year as the other telcos gain market share, and therefore it becomes more likely AMX will receive a license with each passing year. AMX could almost immediately offer its fiber broadband subscribers a bundle including video if it were to receive a video license. However, this should not be a risk for Megacable as cable-based subscribers are unlikely to mix-and-match providers for video and broadband given bundle pricing. Customers using AMX’s fiber network for broadband most likely either use a DTH satellite provider for video or do not have a video subscription.

Business Model Quality: Megacable has a very strong competitive position across its network. The high local market share, low-price model, high EBITDA margins, and soon-to-be latest network technology create a high barrier to entry for competitors. Its competitive position is evidenced by the high and stable return on tangible invested capital over the last five and ten years, averaging 19% and 20%, respectively. Moreover, there remains significant potential for network expansion through organic reinvestment and for penetration to increase within the existing network. Consequently, Megacable should have a long runway for growth. I view Megacable’s business model quality as high. My main concern is the potential for irrational price competition. While there are no signs of price competition today, and no reason for price competition to occur, it is the one risk that could significantly impair the profit pool for all participants. Megacable should be uniquely positioned to remain profitable if this scenario were to unfold, given its local competitive position, but it would still be an undesirable outcome.

Balance Sheet Quality: Megacable has historically maintained a conservative balance sheet. Total cash at the end of Q2 2021 was Ps3.3b and total debt was Ps6.9b. Net debt of Ps3.7b is equal to ~0.3x LTM EBITDA. Essentially all debt is peso denominated. Megacable’s balance sheet quality is high.

Capital Allocation & Management Quality: Operating cash flow has primarily been reinvested organically or distributed via dividends over the last decade. There was one acquisition of size during that period; a portion of Axtel’s residential fiber business was acquired in 2019 for Ps1.15b. The acquired network was in cities where Megacable also had a presence, adding 55k mass market customers, a 1,370 km fiber network, and other related assets. Recent organic investments have focused on upgrading rather than expanding the network, although the network has continued to expand. Megacable started an investment project in 2016 to increase the number of nodes in the HFC network (reducing homes per node and improving service quality). In November 2019, Megacable announced a new project to upgrade 40-45% of the network to FTTH. Around 40% of the project was completed in 2020 and the rest should be completed by early 2022. Capex in 2021 and 2022 will increase from 2020, but then fall over the following few years from >30% of sales to ~20%. Megacable’s tangible ROIC has remained in the high-teens to low-20% range over the last decade while revenue has grown 11.5% per annum, indicating a high-quality capital allocation track record.

Dividend: the policy is for 15% of EBITDA to paid out in a dividend, but ~20% has been paid out in six of the last seven years. The exception was 2019, when the payout was 15% of EBITDA (decided at the board meeting in early 2020). The dividend for 2020 was 20% of EBITDA.

Management: Enrique Yamuni Robles, 66 years old, has served as Megacable’s CEO since the start of its operations in 1982. Deputy CEO, Raymundo Fernandez, was appointed in January 2007, after serving as Director of Commercial Operations at Megacable for over a decade. Luis Antonio Zetter joined Megacable as CFO in May 2010. Management is not part of the controlling families. Mr. Yamuni owns more than 6% of Megacable’s shares outstanding. Management compensation is paid entirely in cash, based on operational (subscriber growth, churn, and ARPU) and financial (growth in revenue, EBITDA, and net income) KPIs.

Ownership: while the free float is listed at 99.5% on CapIQ, according to IR the free float is actually ~35%. This disparity is due to a quirk of the Mexican stock exchange and the fact that the family owns most of their shares in physical form, not electronically. There is no public information regarding which family members own what percentage. IR said that over the years the concentration of ownership has been diluted as shares are given to children and grandchildren. He estimates the 65% ownership is spread across ~80 individuals. The Robinson Bours family also owns 73.3% of Industria Bachoco (NYSE: IBA), the largest poultry producer in Mexico. This stake is currently worth ~$1.7b.

Board: there are twelve directors, four of whom Megacable says are independent. The CEO is a director, six directors bear the Bours name, and one bears the Mazón name. Information on the independent directors is limited.

Chairman: Francisco Javier Robinson Bours Castelo.

Other family members: Sergio Jesús Mazón Rubio, Jesús Enrique Robinson Bours Muñoz (Francisco’s cousin), Juan Bours Martínez (Francisco’s cousin), Arturo Bours Griffith (Francisco’s cousin), José Gerardo Robinson Bours Castelo (Francisco’s brother).

Historical Financial Performance + Valuation Quality: Megacable separates cable operations from other businesses, with cable including mass market and one of the corporate businesses (MetroCarrier). Cable was 91% of revenue and 94% of EBITDA in 2020. (I adjust EBITDA to include lease deprecation and lease-related interest expense as operating expenses. I include both expenses in cable.)

Cable revenue has grown 11% per annum over the last 5- and 10-year periods, while Cable EBITDA has grown 13% per annum. Revenue growth is a function of subscribers and average revenue per subscriber (ARPU). Megacable’s subscribers have grown 5% per annum over the last 5 years and ARPU has grown 3% per annum. Subscriber growth is driven both by network expansion and increased penetration within the existing network. ARPU has benefitted from a rising number of RGUs (services) per subscriber. In other words, Megacable has sold subscribers more double and triple play bundles over the years. With room for growth through network expansion and increased penetration, along with its already industry leading EBITDA margins, Megacable has had little reason to maximize pricing in its network. It typically prices at more than a 30% discount to Televisa and Total Play. Over the long-term, there could be significant room for pricing to drive revenue and profit growth. Free cash flow has fluctuated with Megacable’s reinvestments, but growth and return on invested capital indicate these have been wise reinvestments to-date. After the current FTTH project is completed, capex as a percentage of sales should fall by over 10 percentage points and free cash flow should improve significantly. I believe we can trust management to allocate the incremental free cash flow wisely when the time comes.

Megacable currently trades for 5.5x LTM EBITDA and <10x LTM EBIT. The cable industry is littered with transactions. Transaction multiples over the last several years range from 9x to 11x EBITDA, with a median and average multiple around 10.5x. Megacable’s strong market share across its network, high growth potential, and high EBITDA margin could justify a multiple at the higher end of the transaction range. From a justified multiple perspective, mid- to high-single digit long-term growth and a high-teens ROIC could reasonable justify at least a 14-19x forward EBIT multiple. Revenue, EBIT, and EBITDA are up 9% through the first half of 2021. Extrapolating YTD EBITDA to year-end, a reasonable intrinsic value range based on historical transaction multiples is between Ps.115 and Ps.143 per share (making all the standard EV adjustments). Megacable is currently trading at a 44-55% discount to this intrinsic value range. I view Megacable’s valuation quality as high, given the large discount to conservative estimates of intrinsic value.

(Accounting note: in 2018, Megacable began capitalizing customer acquisition costs and depreciating them over three years. IR said this change was to present EBITDA and the EBITDA margin in a similar manner as Total Play and Televisa. Total Play states that it uses this accounting method in its filings, but Televisa’s filings are not clear regarding this method. IR believes Televisa does use this method. This accounting change increased Megacable’s cable EBITDA margin by ~430bp in 2018. The impact to profit and margin varies depending on the pace of growth in subscribers; more subscribers added means more expenses to be capitalized. For example, subscribers grew 8.4% in 2020 and the capitalized connection costs increased to 5.2% of cable sales. The capitalization of customer acquisition cost presents an EBITDA that is steady-state, or no-growth. We do not need to add back those costs to normalize earnings (if Megacable stopped growing subscribers, those costs would also stop).)

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.