Logista Integral (BME: LOG)

A stable monopoly with limited downside, growth, an attractive dividend yield, and the potential to re-rate

The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable.

June 11, 2024

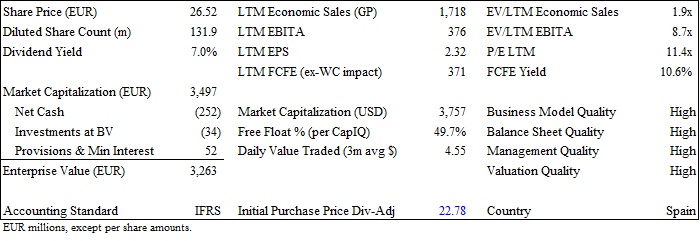

Summary (FYE Sep 30): Logista Integral (Logista or LOG) provides value-added logistics services to local retailers, primarily in southern Europe. Its largest countries of operations are Spain, Portugal, Italy, and France. Logista has a near monopoly on the distribution of tobacco products in Spain, Italy, and France, thanks to national regulations. It trades like a tobacco stock, with the historical stock chart resembling that of Imperial Brands (IMB). However, Logista becomes less connected to tobacco every year. Over the last decade, it has leveraged the tobacco distribution network to expand into other value-added distribution services. Economic sales (i.e., gross profit) from distributing non-tobacco products have increased by a double-digit percentage, on average, since Logista’s IPO in 2014 (per IR). Tobacco was less than 48% of economic sales in FY24 H1, which I estimate compares to >60% a decade ago. A new CEO was appointed in December 2019 and is committed to transitioning the business away from tobacco. Therefore, tobacco could become a smaller part of the business even faster than the historical trend. As some point, the mix of non-tobacco products will be great enough for investors to classify Logista as a logistics company rather than a tobacco company, at which point Logista should be valued at a more appropriate multiple of earnings. (For example, Apollo bought a 49% stake in one of Logista’s largest competitors in Iberia, Primafrio, in 2022 for 17.5x LTM EBIT and 22.5X LTM net income.)

Logista is a stable business growing profit at a mid-single digit annual rate. The trailing free cash flow and dividend yields of 10.6% and 7%, respectively, are too high given Logista’s fundamentals. In the scenario where the valuation multiple does not re-rate, investors will collect at least a 7% dividend on the current share price every year. Over time, it seems highly likely the dividend payment will grow as net income grows. Management has a dividend payout policy of at least 90%. Additionally, the gap between free cash flow to equity (FCFE) and the dividend, along with the “free cash” already on the balance sheet, indicates there is room for the dividend to grow regardless of whether net income grows. Therefore, the downside scenario of investing in Logista, where the multiple does not re-rate, seems acceptable.

Company History: Logista was formed in 1999 through the combination of various distribution companies in Iberia, primarily the distribution assets of Spain’s state-owned monopoly tobacco company. It began acquiring and establishing subsidiaries to diversify operations outside of tobacco in 2002, including Nacex (express courier services in Iberia), Logista Parcel (controlled temperature distribution service in Iberia), and Logista Freight (long-distance and full load transport management). In 2004, Logista acquired what is now called Logista Italia. Logista Polska was created in 2007 to expand wholesale distribution to Poland. LOG was acquired by Imperial Brands when the latter acquired Altadis in 2007/2008. After the acquisition, Logista began managing IMB’s logistics operations in France. Logista fully acquired the France distribution business from Imperial Brands in FY13. IMB listed 30% of Logista in July 2014 and sold an additional 10% in both FY17 and FY18. LOG spent just over €200m on several acquisitions between FY22 and FY23 to accelerate the expansion of non-tobacco related distribution.

Accounting notes:

Revenue does not include VAT, excise duty on tobacco products, or other sales taxes. It represents the selling price of products to the points-of-sale. Cost of goods sold, or procurement expenses, only include the purchase cost of distributed products from manufacturers. Revenue and procurement expenses are both recognized when an item is sold to the points-of-sale. Gross profit (referred to as economic sales) reflects the distribution fee earned by Logista.

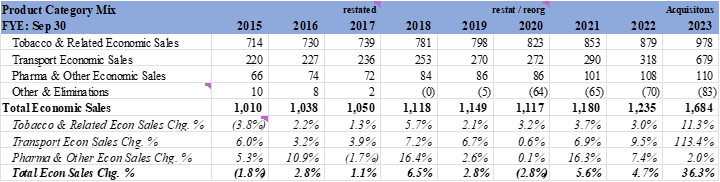

Tobacco and related was 58% of FY23 economic sales, transport was 40%, and pharma and other was 7% (eliminations were -5%). Tobacco and related includes economic sales from the distribution of non-tobacco products. Transport and pharma and other are primarily Iberia operations.

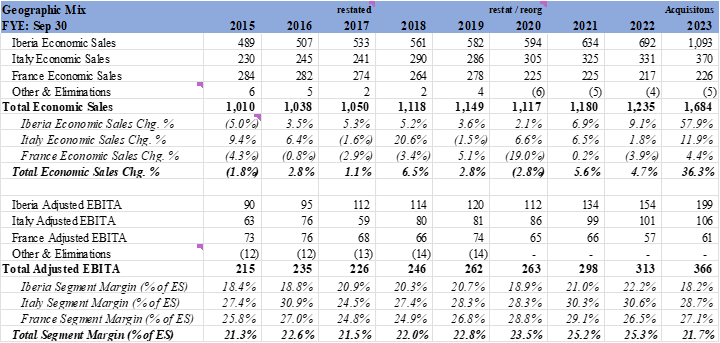

Geographic Segments: The table below shows Logista’s economic sales and adjusted EBITA by geographic region. Iberia was 65% of economic sales and 54% of adjusted EBITA in FY23, Italy was 22% and 29%, and France was 13% and 17%. A couple accounting notes:

Logista moved the Poland operations to Iberia and began allocating corporate expenses to each segment in FY21. Results for FY20 were restated to reflect these changes, reducing EBITA in each segment.

Logista classified Supergroup, a French subsidiary, as a discontinued operation in FY21. Results for FY20 were restated to reflect this change. In FY20, Supergroup accounted for €40.7m in economic sales and (-€6.5m) of operating losses. Covid had an extremely negative effect on Supergroup.

Logista made several acquisitions in FY22/FY23, the majority of which were transport operations that are recorded in Iberia. Iberia had double digit organic growth in FY23. The acquired businesses have lower margins than tobacco distribution.

Business Model

Market Structure for Tobacco: Logista operates in three highly regulated tobacco markets: Spain, Italy, and France. Portugal is not a regulated tobacco market and is therefore quite different from the other three countries. Logista’s market share of tobacco volume distributed is ~99% in Spain, Italy, and France, and ~30% in Portugal. (Logista has close to 100% market share of volume distributed to wholesalers in Portugal, but then it focuses on distributing to proximity retailers rather than large retailers, such as supermarkets. The next biggest wholesaler has ~10% market share.) The key regulations in Spain, Italy, and France are:

Tobacco retailers (i.e., tobacconists) operate under a retail monopoly framework and are required to obtain a license to sell tobacco products. Wholesalers and manufacturers are not legally allowed to act as tobacconists and vice versa.

Manufacturers are required to guarantee distribution of tobacco products to all tobacconists in the country. Moreover, tobacco must be supplied to all tobacconists on a similar level of service.

Tobacconists are only permitted to purchase tobacco products from wholesalers (such as Logista). Manufacturers must use wholesalers and distributors that are approved by the regulator in each country. Tobacco distribution requires well-managed and traceable distribution networks to comply with track-and-trace regulations and to maximize excise tax collection for governments.

Retail selling prices (RSP) for tobacco products are set by the manufacturer in each market and may not be changed by the wholesaler or the tobacconist. Regulators in each country set the commission rate for tobacconists, while wholesalers negotiate with manufacturers to set distribution fees.

These regulations naturally lead to a single nationwide distributor. Logista has partnered with the four major tobacco manufacturers – Philip Morris International, British American Tobacco, Japan Tobacco, and Imperial Brands – and their legacy organizations for over twenty years. These relationships are managed through multi-year contracts, and Logista has a 100% retention rate with the major tobacco manufacturers. As next generation products (NGP) have grown in popularity, each tobacco manufacturer has extended the partnership with Logista to cover these products as well.

Wholesaler/Distributor: Logista operates a hybrid wholesale-distribution business model. The range of services offered includes: transportation from production facilities in central and eastern Europe, in-country warehouse management, order collection, transportation to points-of-sale (tens of thousands in each country given the retail structure), invoicing, payment collection, excise tax collection and payment, local promotional activity, after-sale service, in-store inventory and sell-through data by SKU, and much more. Logista’s proprietary technology infrastructure provides real-time traceability of each product from the manufacturer’s plant through sale by retailers. Where wholesalers purchase inventory and then sell to retailers at a marked-up price, Logista is not involved in pricing. Manufacturers set retail selling prices (RSP) and Logista charges a fee based on volume (discussed below). Additionally, Logista provides complete transparency and traceability to manufacturers, which traditional wholesalers would not provide.

Most of these services are part of Logista’s “standard” offering provided to tobacco manufacturers. However, some services are offered for an additional fee. The two main add-ons are the international transportation of goods and point-of-sale data.

Logista Freight, a long-distance and full load transport management subsidiary, is increasingly employed by tobacco manufacturers to transport products from plants in central and eastern Europe to Logista’s warehouses and the warehouses of other wholesales (e.g., in Poland and Portugal). International transportation services are fully traceable and operate under strict security standards.

Logista has unique access to tobacconist data through its network of over 73k proprietary POS terminals. These terminals and their connection to Logista’s enterprise software provide unique insight into inventory and sell-out data for each store and SKU. POS data can be beneficial to tobacco manufacturers trying to optimize local offerings. It is also valuable as NGP are introduced to various markets. The terminals are also used by retailers to order products from Logista, as terminals digitally display Logista’s entire portfolio of offered products (tobacco and non-tobacco).

Prices & Volume: Distribution fees are based on volume, with higher volumes incurring a lower fee per unit. Volume is measured per SKU, not by company or by brand. More SKUs for the same total volume means higher fees for Logista. Volume fees include a standard package of services, with additional value-added services offered for an additional fee. The per unit fee schedule is the same for each manufacturer in a country, but it differs for each country. Retail selling prices do not factor into Logista’s distribution fees. Pricing contracts are updated annually and automatically incorporate changes in fuel costs and CPI to the per unit fee schedule.

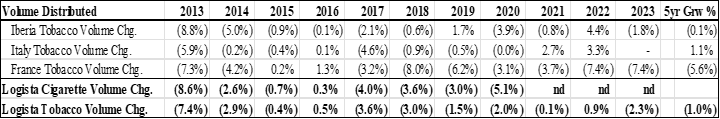

To restate the moving parts in tobacco fees: 1) lower volume increases the fee per unit; 2) more SKUs for the same volume increases the fee per unit; and 3) value-added services are an additional fee. As shown in the table below, and is widely known, tobacco volume in Logista’s markets has generally been declining for many years. The decline has been most pronounced in France, where regulations have been extremely stringent. Tobacco volume has not declined as fast as cigarette volume, however. In Italy specifically, tobacco volume has grown over the last three years despite a low single digit decline in cigarette volume each year. This is due to growth in roll-your-own/make-your-own products and the introduction of next generation products (NGP). Based on the different drivers listed above: lower volume means lower revenue; lower volume also means a higher per unit fee, which increases revenue; and more SKUs (e.g., with the introduction of NGP) for the same volume means higher revenue. Manufacturers are increasingly using Logista’s value-added services. According to IR, tobacco economic sales are still growing by a low single digit percentage. Logista expects tobacco economic sales to at worst remain flat for the next few years, even if tobacco volume continues to decline.

Tobacconists & Proximity Channels: Logista has offered distribution services for non-tobacco retailers and for non-tobacco products since at least 1999. However, it was only in the last decade or so that tobacconists fully realized the need to diversify their offering. Minimal incremental effort is required by tobacconists to expand their product portfolio beyond a willingness to do so. All wholesale and distribution services are handled by Logista, who these retailers already intimately know. Moreover, products can be ordered through Logista’s POS terminals, where the available product portfolio is displayed. With the sell-out data generated by the terminals, Logista is also well equipped to advise tobacconists on which additional products to offer. Additional products started with tobacco accessories (papers, filters, lighters, grinders, etc.) and then moved to consumer goods (food, beverages, health and beauty, telephone cards, magazines, etc.). As more tobacconists began using Logista for non-tobacco products, the opportunity with non-tobacconist retailers expanded as well. There remains significant potential to expand the distribution of non-tobacco products to both tobacconists and non-tobacconist retailers.

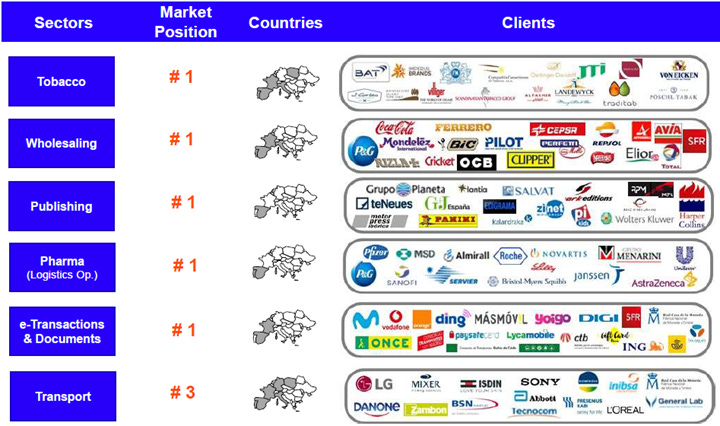

One of Logista’s first major non-tobacco distribution agreements was with Repsol in Spain in 1999. Logista agreed to handle distribution for products selected by Repsol to be sold in its petrol stations. As of FY14, Logista distributed ~3.6k SKUs – including food (both refrigerated and ambient temperature), beverages, boutique items, drugstore products, consumable goods, auto parts, and other accessories – to over 2.5k Repsol petrol stations in Spain. A similar agreement was later signed with Repsol in Portugal and Cepsa in Spain, the latter started in FY20. Today, Logista offers products from a wide range of manufacturers to ~200k points-of-sales in Iberia, Italy, and France. The logos for many of its clients are highlighted in the image below.

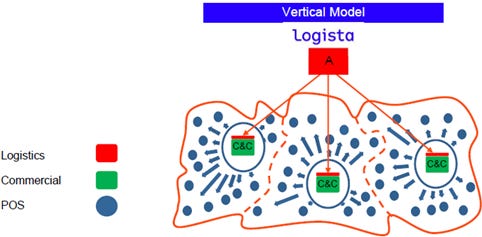

Infrastructure & Expansion into Other Services: The infrastructure required to support regular distribution to tens of thousands of retailers across multiple countries is significant. Logista’s operations are relatively asset-light; over 600 central/regional warehouses and local service points are internally operated, but distribution is done mostly through subcontracted fleets. Central/regional automated warehouses handle all in-bound goods before shipping to local services points that act as both distribution hubs and cash and carry stores for local retailers. Although distribution fleets are subcontracted, Logista maintains full control of the design and management of the delivery routes and fleets. Third-party fleet operators are selected based on strict quality and security criteria, and each truck is Logista-branded (or branded through a Logista subsidiary).

The creation of these nationwide networks, which are required to service tobacco manufacturers given the regulations, would be difficult duplicate, making it highly improbable tobacco manufacturers would switch distributors. Additionally, using a vertical model, as depicted in the image above, reduces the cost of serving incremental points-of-sale. This has enabled Logista to profitably expand channels in its markets. There are also natural business extensions from such a sprawling infrastructure beyond retail distribution. Transport and pharma are Logista’s main ventures in extension opportunities.

Two of the transport subsidiaries – Logista Freight and Logista Parcel – were at least partially created to support the point-of-sale distribution business. Logista Freight has always generated over half its revenue internally, transporting tobacco products internationally to Logista’s warehouses. Over time, Logista Freight expanded its services to external customers and non-tobacco products. External customers include Apple, Sony, LG, Novartis, and L’Oreal, among many others. Logista Parcel manages temperature-controlled distribution of products to convenience stores, such as Repsol’s petrol stations. It also supports Logista Pharma in the traceable temperature-controlled delivery of pharmaceutical products. Expansion of these services to external customers was also natural. Nacex (the third major transport subsidiary) has never generated a significant portion of revenue from internal operations, but its services are a reasonable extension of a nationwide distribution infrastructure that supports frequent deliveries.

Pharma distribution has similarities with tobacco distribution in Logista’s markets, in that it is highly regulated. Distributors must hold a pharma distribution license and provide batch-level traceability for each shipment. Moreover, distribution typically must be temperature-controlled. Warehouses must also obtain authorization to distribute, warehouse, and handle pharmaceutical products, while providing batch-level traceability services. Logista’s traceability infrastructure for tobacco and temperature-controlled network via Logista Parcel made pharma distribution a natural opportunity. Evidencing Logista’s capabilities in pharma is the agreement signed with Sanofi to manage the distribution of its entire product portfolio to hospitals, pharmacies, and wholesalers in Spain starting October 1, 2017. Logista also played a significant role during the covid pandemic, delivering the covid vaccine (required traceable temperature-controlled distribution to ~13k locations), distributing supplies related to administering the vaccine, and expanding services to provide direct-to-patient delivery of clinical trial supplies and other hospital medicines, among other services.

Transport and pharma primarily operate in Iberia, but management wants to expand these businesses to Italy and then France. Even without geographic expansion, though, there remains significant growth potential for each of these businesses.

Business Model Quality: Logista’s monopoly market position in tobacco distribution gives it a strong competitive advantage in its core markets. Logista has used this position to expand into non-tobacco value-added distribution services, leveraging some of the infrastructure / technology / relationships / know-how of the tobacco distribution business. The incremental cost of expanding into these services is relatively low given Logista’s existing infrastructure. For these reasons, it is difficult to compete with Logista in its core markets. There is also a long runway for growth, as distribution of non-tobacco products in Logista’s core markets remains fragmented. I view Logista’s business model quality as high.

A key risk to Logista’s business model is a change in regulation for tobacco distribution and retail in its core markets.

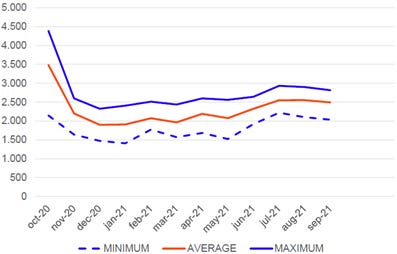

Balance Sheet Quality: Logista had ~€252m in net cash and short-term financial assets at the end of March 2024. Logista handles collection of VAT and excise taxes on tobacco products in its territories on behalf of local governments. Payment terms for these payables vary by country but average 35 days. As a result, Logista constantly has a large negative working capital position. Logista is essentially receiving an interest-free short-term loan from the government in exchange for collecting VAT and excise taxes from thousands of small retailers. It lends a portion of the collected cash to Imperial Brands (majority owner of LOG) through a credit line agreement. The agreement allows IMB to draw up to €3.0b of Logista’s surplus cash throughout the year. (The agreement terminates with a change in control at Logista.) The credit line was recently adjusted to comprise two tranches: 1) the first €1.0b pays a fixed rate of 3.615% and 2) all borrowings above €1.0b pay the Euribor 6m rate +75bp. These terms are effective from June 2024 to June 2027. If Logista was independent, this loan would probably not exist. However, the entire loan balance is not “free cash” for Logista; most is required to pay excise taxes throughout the year. The image below shows Logista’s cash balance including the loan to IMB throughout FY21, the last time this chart was disclosed. Logista’s balance sheet quality is high.

Management Capital Allocation Quality: Logista’s dividend payout policy is at least 90% of adjusted net income, which it has delivered every year since 2015. Maintaining a dividend payout ratio of at least 90% is a priority for management. Logista operates an asset-light business model, with capex typically less than 3.5% of economic sales. Logista spent just over €200m on several acquisitions between FY22 and FY23. Acquisitions have been small to medium in size to ensure Logista can digest and integrate them appropriately. Management is focused on deals outside of tobacco that build on Logista’s strengths – providing value-added logistics services in Iberia, Italy, and France. The fragmented nature of logistics services in these markets means there is a long runway for these types of deals. LOG’s ROE has risen from ~32% in 2019 to ~47% in 2023, with just one down year (fell to 30% in 2020). During this period, economic sales grew 10% per annum, EBITA grew 9% per annum, and EPS grew 13.5% per annum. Overall, I believe LOG’s management team is high quality, with a solid capital allocation record.

Chairman: Gregorio Maranon Y Bertran De Lis, 82 years old, was appointed Chairman of Logista in 2008.

CEO: Inigo Meiras was appointed in December 2019 following the death of Luis Egido, who was the long-time CEO of Logista. Meiras was previously the General Manager and CEO of Ferrovial SE from 2009 until September 2019. He is committed to reducing the importance of tobacco to Logista over time, primarily through M&A.

CEO annual variable compensation is based on three metrics: 60% on adjusted EBIT, 15% on working capital, and 25% on personal contributions. Long-term incentive plans are based on three-year performance targets: 65% on EBIT, 25% on comparative shareholder returns with other companies, and 10% sustainability objectives. Companies used for TSR comparison: BATS, Deutsche Post, ID Logistics, IMB, JTI Inc, McKesson Corp, PM, Stef S.A., XPO Logistics.

Shareholders: Imperial Brands (IMB) is the largest shareholder with a >50% stake. IMB owned 100% of Logista until the IPO in mid-2014, when ~30% was sold to the public. IMB sold an additional 10% stake to the public in both 2017 and 2018. Logista has always been managed independent of Imperial Brands. That said, IMB has five (out of twelve) directors on Logista’s board of directors.

Historical Financial History + Valuation: the image below highlights a few financial metrics: economic sales growth, EBITA growth, net income growth, FCFE conversion, dividend per share growth, and the contribution of net interest income over time.

The operating results (i.e., economic sales and EBITA) have shown strong growth over the last several years. Keep in mind that Logista discontinued Supergroup in France in FY21 (€40.7m in economic sales in FY20) and made several acquisitions in FY22/FY23. Organic growth for both economic sales and adjusted EBITA was a double digit percentage in FY23.

FCFE (ex-WC changes) has averaged ~130% of net income over time, and 80-85% of EBITA. (WC is typically a cash benefit, but it can fluctuate significantly based on the timing of excise tax collection and payment.)

Interest income increased sharply in FY23 with the rise in interest rates, following a decade of rock-bottom rates in Europe. Logista locked in higher interest rates on the credit line with IMB through at least FY27. The locked in rate of 3.615% is below current rates but above historical rates.

Logista currently trades for <9x LTM EBITA and <12x LTM EPS. Guidance is for adjusted EBITA to grow at a mid-single digit rate in FY24. Considering Logista’s monopoly market position in tobacco distribution, the incremental distribution opportunities this market position provides, the negative invested capital required to operate, the steady operating performance, and the long-term growth potential from expanding non-tobacco operations, a <9x EBITA multiple seems very low. Normalizing EPS and determining the appropriate P/E multiple requires making a call on European interest rates. The EU has already begun lowering interest rates, but Logista locked in higher than historical rates for ~50% of its credit agreement with IMB. Applying the 3.615% fixed interest rate to Logista’s entire loan to IMB at FYE23 implies interest income of €83m (€99m LTM). This is roughly in line with the interest income earned in FY23. Therefore, interest income included in FY23 EPS can be viewed as a reasonable approximation of normal interest income even though it is much higher than historical interest income. I view Logista’s valuation quality as high, given the attractive FCFE (10.6%) and dividend yields (7.0%) compared to the company’s fundamentals.

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.