The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable.

UPDATED: November 10, 2024

Summary (FYE Dec 31): Edenred provides specific-purpose payment solutions that allow businesses to 1) give tax-advantaged benefits to employees (largely meal and food benefits), 2) control mobility purchases by employees (largely fuel cards), and 3) make payments to suppliers (corporate payments). Benefits & Engagement (B&E) is 65% of operating revenue, Mobility is 24%, and Complementary Solutions is 11%. Corporate employees are the end users for most of Edenred’s payment solutions, but Edenred’s customers are the corporations. Merchants join Edenred’s acceptance network to access the employees using its payment solutions. Edenred offers merchants traffic generation—high frequency, recurring traffic for specified products and services—in exchange for a percentage of business volume. Edenred earns a fee each time a solution is used—typically ~1/3 from the client and ~2/3 from the merchant—and interest income on the prepaid benefits (i.e., float) until they are redeemed. Geographically, Edenred’s business has shifted toward Europe (61% of operating revenue and ~70% of EBIT) and away from LatAm (~30% and ~29%) over the last decade.

Business Characteristics: Edenred’s payment solutions have high recurring revenue, low churn and low market penetration. The financial features include operating leverage (high 30% EBITA margins), low capital intensity, and high cash flow generation (FCFE averages >100% of net income ex-2020). Edenred’s ROIC has ranged from 30-40% for most of the last decade (20-30% excluding float income). The return on incremental invested capital over the last several years has averaged ~25%, weighed down by a meaningful acquisition in 2023 that is not yet fully reflected in earnings. The return on incremental invested capital through 2022 was >35%.

Competitive Advantage: Barriers to entry include network effects, high fragmentation among clients and merchants, significant investment required to create the payment infrastructure, complexity in managing many specific-purpose payment systems, and needing an established reputation to handle prepaid benefits from clients. Scale is critical for Edenred’s payment solutions, specifically local scale but also global scale. Local and global scale lead to higher margins, due to the fixed cost nature of the business, and allow for greater investment in technology and the product offering. Edenred is the largest provider of B&E solutions with ~40% global market share. It is #1 in countries that generate ~75% of its B&E revenue. The #2 (Pluxee) and #3 (Groupe Up) players each have 20-25% global share, so Edenred has high relative market share and the industry is consolidated. Importantly, most of the operating revenue comes from the merchants rather than the clients, but it is the aggregation of the client’s employees that primarily defines local scale and drives the revenue from merchants. Edenred’s local scale (number of users) and local networks (clients + merchants) are a strong moat against competition.

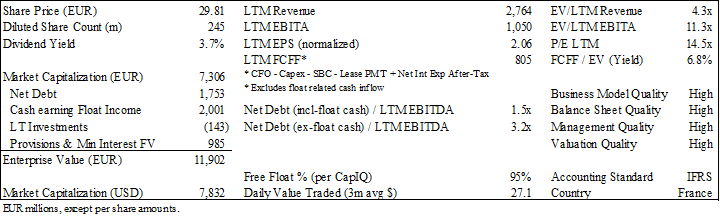

Valuation: Edenred trades at ~14.5x P / LTM normalized EPS and ~15x EV/ LTM FCFF (~7% EV yield; ex-float related cash inflow). FCFF has grown 19% per annum over the last five years, while organic revenue growth has averaged 13% over the same period. Management expects EBITDA to continue growing at a double-digit rate for years to come. Even at half of that growth rate, though, the prospective multi-year equity IRR at the current valuation is in the low teens (assuming a stable EV multiple). A multi-year IRR in the low teens is attractive considering Edenred’s business quality. From a relative perspective, Edenred trades at the lowest forward P/E multiple in its history and at the largest discount to the S&P 500 ever. Finally, historical transaction multiples for payment companies (16-22x EBITDA) also support the view that Edenred is materially undervalued—the shares trade for <10x 2024E EBITDA. Edenred has a 3.7% dividend yield and is on track to repurchase >3% of shares this year. This is the first year Edenred has repurchased shares beyond just offsetting dilution. It began repurchasing shares after the share price fell sharply early in the year.

Why It Is Undervalued: The key issue weighing on the stock price over the last year seems to be proposed regulation changes for meal and food benefits. (Meal and food benefits are ~45% of operating revenue.) These proposals began in Brazil in 2022, expanded to France in 2023, and were recently announced in Italy. The proposals are not about ending these benefits. Instead, proposals focus on reducing the fees charged to merchants. No meaningful regulation changes have been implemented yet, but the proposals are a real risk. That said, none of the changes pose an existential threat to Edenred. Regulation changes such as those being proposed would entrench the market leader—Edenred—by raising the barriers to entry and improving its relative competitive position. New entrants will need even greater user scale to cover fixed costs, and smaller players will have less revenue to invest in technology, services, marketing, and sales. Therefore, a short-term hit to profitability could be more than offset by a greater certainty of Edenred maintaining (probably gaining) market share in the future.

To briefly discuss the proposed regulations:

In 2022, Brazil passed a law allowing workers to move meal credits between providers and then use them at any participating restaurant. Implementation of this system was delayed to May 2024 and then delayed indefinitely. The complexity and massive investment required to implement such a system quickly became apparent after the law was passed, leading to the effective cancellation of its implementation.

In October 2023, two B&E-related regulations were proposed in France: 1) the introduction of a price cap for fees charged to merchants that accept meal and food benefits and 2) the removal of each provider’s exclusive right to accept the meal and food vouchers it issues. Edenred’s share price fell sharply the day of the announcement. Neither of these proposals has gained traction with lawmakers so far, but the implementation of either could negatively affect near-term earnings. Bills currently being written and proposed by France’s new government reportedly do not include either of these proposals.

In October 2024, Italy proposed a regulation to cap merchant fees for meal and food benefits at 5%. The proposal will be voted on in Q1 2025. If passed, providers will have 1 year to implement the cap. Italy’s meal and food benefit industry is unique in that corporate clients receive a rebate for using a specific provider (i.e., corporate clients essentially get paid) and merchants pay very high fees (could be over 10%). One explanation for this system is that providers are very selective when adding merchants to their networks, allowing them to direct significant traffic to those that are on the network and therefore justify a high fee. Whether this specific cap is implemented or not, commentary from Edenred’s management indicates that merchant fees in Italy will come down over time.

A significant barrage of regulation changes—defined as a 50% reduction in merchant fees in both France and Brazil and implementation of the proposed merchant fee cap in Italy—would reduce Edenred’s EBITDA by ~20%. It is worth repeating that due to the fixed cost nature of the business, a 20% decline in profitability for a market leader will mean a significantly greater percentage decline in profitability for smaller players in these countries. Guidance is for at least 12% EBITDA growth in 2025 before the Italy fee cap and at least 10% growth if the fee cap is implemented. Therefore, the significant regulation change scenario could negate 1-2 years of EBITDA growth. If Edenred’s EBITDA does not grow for two years and then returns to a 6-8% CAGR for the following 8 years, the 10-year EBITDA CAGR is still 5-6%. With the shares trading at a ~7% FCFF / EV yield, this pessimistic regulatory scenario still implies a double digit equity IRR over a 10-year period (assuming a stable EV/EBITDA multiple). It seems that the market is currently pricing in more than this pessimistic regulatory scenario. At the current price, therefore, the margin of safety is large enough to allow for significant adverse developments before the prospective equity return becomes inadequate. If these regulatory proposals are never implemented, Edenred’s EBITDA should continue growing at a double digit percent, on average, and the multiple should rerate significantly (easily >30%) higher.

Company Overview: Edenred was founded in 1954 and is headquartered in France. It was a subsidiary of Accor Group from 1982 to June 2010, when it demerged as a public entity. Edenred provides specific-purpose payment solutions for ~1m corporate clients, more than 60m employees, and over 2m merchants. The payment solutions are separated into three segments: Benefits & Engagement (B&E) 63% of operating revenue in 2023, Mobility 25%, and Complementary Solutions 12%. (Profitability is not disclosed by operating segment.) B&E solutions are primarily for meals and food groceries, but also include childcare, well-being, human services, and culture. Mobility includes fuel, tolls, maintenance, parking, VAT reimbursement, EV charging, and freight matching. Complementary Solutions includes Corporate Payments, Incentives & Rewards, and Public Social Programs. These are all specific-purpose solutions, meaning they control where the money can be spent, when it can be spent, what it can be spent on, and how much can be spent. How these solutions compare to a general-purpose payment solution (such as a debit or credit card) is shown in the image below.

Benefits & Engagement: Meal and food benefits accounted for ~69% of B&E revenue in 2023. These are regulation-dependent benefits, where the contribution of a corporation and its employees is tax advantaged. Regulations also determine how much can be contributed each period, an amount that typically rises over time (especially recently) to at least match inflation. Not every country has these regulations and there is no uniformity between those that do, meaning a unique solution is required for every country. More countries are adopting B&E-related regulations thanks to industry lobbying. Other B&E solutions, “Beyond Food”, are typically not regulation dependent. Instead, Edenred leverages the aggregate scale of its local users to negotiate discounts with local merchants. France and Brazil are Edenred’s largest B&E markets, with the former accounting for ~19% of B&E operating revenue in 2023 and the latter accounting for ~17%. Specifically in France, meal and food benefits are ~60% of Edenred’s B&E operating revenue (7% of Edenred’s total operating revenue).

For meal and food benefits: corporations select a solution provider; the corporation and its employees contribute pre-tax income to accounts with that provider; the provider issues the money to the employees through paper vouchers, prepaid cards, or digital wallets; and the employees spend the “business volume” at approved merchants (local restaurants, grocery stores, Uber Eats, Deliveroo, etc.). Corporations are typically required to contribute at least 50% of the business volume (employers contribute essentially all the business volume in Brazil). Other B&E solutions follow a similar format except contributions are typically not pre-tax.

The key barriers to entry are local and global scale and low customer churn. Local and global scale lead to higher margins, due to the fixed cost nature of the business, which allows for greater investment in technology and the product. A large local user base also attracts more merchants to the platform. The product quality and the local merchant network attract corporate clients. Building and maintaining a network of local corporations and local merchants requires a large sales force, given the fragmented nature of each. Corporations normally sign 2- or 3-year contracts and churn is low—a single digit percentage annually depending on the country. It is even lower for corporations using multiple B&E solutions. Choosing a B&E provider is the responsibility of HR, who typically prioritizes benefits offered, familiarity with the provider and platform, and ease of use over cost. Importantly, most of the operating revenue comes from the merchants rather than the corporate clients, but it is the aggregation of the corporate client’s employees that primarily defines local scale and drives the revenue from merchants.

There are three global players and several regional and local players. Edenred is the largest player with ~40% global share, Pluxee has ~25%, and Groupe Up has ~20%. The largest countries with meal and food benefit regulations are highly consolidated. For example, 4 players represent 90-95% of the market in France and 4 players represent over 90% of the market in Brazil. Swile is a meaningful competitor in France and Alelo is the largest player in Brazil.

In 2023, around 75% of Edenred’s B&E operating revenue was generated in a market where it is #1. (Brazil is 17% of B&E revenue and the main country were Edenred is not #1. It is #2 or #3 with 20-25% market share.) Edenred reinvests a significant portion of its scale advantage into capex and bolt-on acquisitions. These investments have bolstered its competitive position over time, and it has gained global market share over the last several years. Specifically in France, Edenred’s market share has risen from ~35% in 2016 to >40% in 2023.

Mobility: Fuel cards accounted for ~70% of Mobility revenue in 2023, with “Beyond Fuel” services accounting for the other ~30%. These solutions all follow a similar format: corporations select a solution provider; the employees are given cards (debit or credit) that can only be used for specific expenses (fuel, tolls, parking, maintenance, business travel, etc.) and at specific merchants; and spending data is tracked and analyzed to reduce costs and improve efficiency. In addition to lower costs and greater efficiency, Edenred leverages the aggregate scale of its local users to negotiate discounts with local merchants. These are not regulated solutions. Brazil is Edenred’s largest Mobility market, accounting for 38% of segment operating revenue in 2023.

Customers are primarily vehicle and fleet operators, but Edenred also manages fuel card programs for third parties, such as oil companies and retail chains. Fleet operators pay a small percentage of the fee charged by a payment solution provider, while most save ~20% on annual fuel expenses by using fuel cards (according to CPAY and WEX). Fuel (~30%), road services (~10%), and vehicle maintenance account for a significant portion of a truck fleet’s total operating costs. Choosing a payment solution provider is about monitoring, controlling and reducing the entire cost structure. Providing solutions and savings beyond fuel cards makes a specific provider even more attractive. This logic has driven Edenred’s expansion beyond fuel cards (e.g., freight matching was added a few years ago). Testing and adding solutions in adjacent mobility categories, like freight matching, is relatively cheap and easy because Mobility is entirely digital.

The key barriers to entry are local scale, regional scale, and overall scale. Local scale creates and enhances a local network effect; a large local user base lowers the cost per user and increases bargaining power with merchants for lower prices, which makes the service more appealing to other users. Building and maintaining a large network of clients and merchants also requires a large sales force. Regional scale is also important, especially in Europe, as transport operations frequently cross borders. Payment providers are more attractive if their solution covers the entire area a fleet may travel. Overall scale spreads the common costs (e.g., software development, cyber security, application of best practices, brand development, relationships, etc.) across more volume. Customer attrition is low—a single digit percentage annually depending on the country.

There are only two global fuel card providers: Edenred and Corpay. WEX has some international operations but is primarily a US player. Major oil companies are the other source of competition. However, fuel cards from oil companies typically only work at their network of stations. Additionally, some of the oil companies are outsourcing their fuel card systems to specialists like Corpay and Edenred. Edenred is the largest mobility solutions provider in Latin America and the fourth largest in Europe (2 of the top 3 are major oil companies), with stronger positions in specific European countries. DKV is the largest provider of mobility payment solutions in Europe, including fuel cards, toll solutions, and vehicle maintenance. DKV was preparing to IPO in late 2023 / early 2024 but decided against it due to the market conditions in Europe. Edenred has previously expressed interest in acquiring this family-controlled company.

Complementary Solutions: Incentives & Rewards and Public Social Programs accounted for ~60% of 2023 revenue and Corporate Payment Solutions (CPS) the other ~40%. Incentives & Rewards provides employers with incentive programs for employees. Public Social Programs manage and distribute social benefits for local and federal governments, improving the traceability of and control on allocated funds. These both have similar business models to B&E except the former is not tax advantaged and the latter is for governments.

CPS provides software that simplifies and streamlines the accounts payable process. It tracks and records transactions with suppliers, reconciles financial statements, and facilitates payment to suppliers. Fees are a portion of the interchange on each transaction (typically less than 1% of volume). Edenred launched CPS in 2016 in partnership with Corporate Spending Innovations (CSI). The partnership was Europe-focused; CSI is a NA company. Edenred acquired CSI in November 2018 to accelerate its expansion into corporate payments. The potential market for corporate payments is massive; over 40% of supplier payments in NA are still made with cash or check. Cash and check payments are inefficient, relatively expensive, and carry risks related to fraud and theft. Therefore, there is a significant opportunity for organic growth. CPS should account for a higher percentage of this segment over time, as its growth outpaces the other services.

The key barriers to entry for CPS are network effects and overall scale. Providers need a network of vender that accept their solution to attract clients and a network of clients to sign up venders. Overall scale spreads the common costs (e.g., software development, cyber security, application of best practices, brand development, relationships, etc.) across more volume. Since the revenue earned on each dollar of volume is small, service providers need to process significant volume to cover fixed costs. Creating a meaningful network involves hundreds of clients, thousands of vendors, and hundreds of millions in business volume. Customer turnover is low as the onboarding process can take several months and contracts are typically multi-year.

Geographic Segments: Europe was ~61% of revenue and ~70% of EBIT in 2023; Latin America was ~30% and ~29%; and Rest of World was ~9% and ~4%. Edenred’s geographic mix has shifted toward Europe over the last decade and away from Latin America. This is shown in the charts below. Venezuela and Argentina are no longer meaningful revenue or profit contributors (each was a decade ago). Brazil and France are Edenred’s largest markets, accounting for ~20% and ~15% of operating revenue in 2023, respectively.

Business Model: Edenred earns a fee each time a solution is used (operating revenue) and interest income (other revenue or float income) on prepaid business volume (i.e., float) until it is redeemed. Operating revenue is typically ~1/3 from corporate clients and ~2/3 from merchants. Edenred refers to operating revenue divided by business volume as the take-up rate. Growth in operating revenue is primarily a function of growth in business volume and changes in the take-up rate. Float income is a function of prepaid business volume and interest rates. Float income drops directly to the bottom line, accounting for ~8% of total revenue and ~21% of EBITA in 2023.

Business Volume Growth Potential: The image below shows the business volume TAM and penetration rate for each of Edenred’s payment categories. Penetration rates for meal and food benefits in countries with the appropriate regulation ranges from 10% to 50%, and fuel card penetration is ~30% in Brazil and ~40% in the EU. There is clearly a long growth runway for each of Edenred’s payment solutions. Edenred is targeting €5b in total revenue by 2030, a ~10% CAGR from the €2.5b achieved in 2023. Growth is expected to come 60% from increased penetration in core markets, 30% from greater expansion into “beyond” categories (Beyond Food and Beyond Fuel), and 10% from new businesses. It is worth emphasizing that you are not paying for 10% annual growth at the current valuation.

The market growth of each category should at least be double GDP growth for the next several years. To illustrate using data from Pluxee’s recent prospectus: the market for meal and food benefits is currently ~€53b, which is a penetration rate of just 24% (i.e., the TAM in countries with the relevant regulations is ~€219b). If the TAM grew with inflation (est. 2%) for the next 10 years and penetration increased one percentage point per annum, reaching 34% in 2034, market growth would average ~5.6% for the next decade. The market grew at a ~7.5% CAGR from 2019 to 2023. Mobility should also see an MSD to HSD market growth rate for the next decade, while the corporate payments market should grow at an HSD to DD rate given an even lower penetration rate.

Edenred’s business volume grew 8% and 9% per annum during the five and ten years through 2023, reaching ~€41b last year. Growth in business volume is a function of the number of employees using Edenred’s solutions and the average spend per user. Edenred’s users grew ~3% per annum over the five and ten years through 2022. (The acquisition of Rewards Gateway in early 2023 distorts the comparability of user data.) The implied annual growth in volume per user over the same periods is 4-5%. Volume per user is primarily driven by growth in the volume of existing solutions, but also from an expansion of services provided—Beyond Food and Beyond Fuel.

For regulated B&E solutions, governments set the maximum amount that can be contributed each period. This amount tends to increase over time, at least with the rate of inflation but usually faster than inflation. Some countries, such as France, increase the maximum contribution each year. Other countries increase the maximum contribution every 2-3 years. In 2022, 43% of Edenred’s B&E countries increased the maximum contribution amount, followed by 52% of countries in 2023. The image below shows the scale of increase for select countries in 2021 and 2022. Inflation should be the floor for annual growth in Edenred’s business volume.

Increasing the maximum contribution amount does not necessarily mean an increase in contributions. In fact, it takes around 24 months for average contributions to reach ~85% of the new maximum contribution after an increase. Given the number of countries that have increased the maximum contribution in the last two years, growth in business volume should be supported through at least 2025.

Expansion services—Beyond Food and Beyond Fuel—have increased from ~21% and 0% of segment revenue, respectively, in 2016 to ~34% and ~32% in 2024E. Edenred has expanded into these services largely through bolt-on acquisitions, typically acquiring established networks of users and merchants in countries where it already has a strong presence in either meal benefits or fuel cards. Expansion services are typically not regulated and are complimentary to meal benefits and fuel cards. These services have a low customer acquisition cost because they are sold to existing customers through the representatives used for meal benefits (HR) and fuel cards (fleet head) and issued to end users through existing digital channels. Expansion services not only increase revenue per user at a high incremental margin, but they also significantly reduce customer churn. Edenred expects these services to continue increasing as a percentage of operating revenue over time.

Take-up Rate: The other driver of operating revenue is the take-up rate. Edenred’s B&E take-up rate has increased from 4.7% in 2017 to 5.5% in 2023, and the overall take-up rate has followed a similar trend. Again, typically ~1/3 of operating revenue comes from corporations and ~2/3 comes from merchants. Edenred can charge merchants multiple percentage points of the business volume because it has aggregated local users and their benefit dollars, which are spent on a regular basis (usually daily). Merchants that opt out of Edenred’s network are opting out of significant incremental, high frequency revenue (a benefit of local user scale). Edenred’s digitalization, which accelerated after the current CEO was appointed in late 2015, has significantly contributed to the rising take-up rate over the last several years.

Digitalization has several important benefits for B&E: 1) corporations will pay more for a digital solution, because it is more efficient and easier for their employees to use; 2) digital programs are easier for SMEs to join and manage—Edenred signed 5x more contracts with new clients in 2022 than in 2015—and smaller corporations and merchants pay higher take-up rates; 3) digital solutions have higher switching costs; 4) it is easier for Edenred to introduce additional solutions and features digitally, which further raises switching costs as competitors must be able to match the entire range of services that users have come to expect; and 5) digital solutions have greater upfront costs but lower ongoing costs for Edenred, thereby enhancing the benefits of scale. Countries that transitioned to a digital solution over the last several years saw a multiple percentage point increase in margin. Well over 90% of Edenred’s B&E segment is now digital, with France the primary laggard at just 65-70% digital. Edenred is a leader in digital B&E solutions, while competitors like Pluxee and Groupe Up were late to transition.

Mobility is similar to B&E: a fee is generated every time a payment is made, with ~1/3 of the fee paid by the corporation and ~2/3 paid by the merchant. Mobility fees can be a percentage of the business volume, an amount per liter of fuel purchased, or a flat transaction fee. Around 40% of Mobility revenue is sensitive to a change in oil prices (~9% of Edenred’s total revenue).

It seems unlikely that Edenred’s take-up rate can continue to increase. Its rise contributed between 2 and 4 percentage points to Edenred’s annual growth over the last five and ten years. I expect the contribution to decline toward zero going forward.

Organic Growth: Growth in operating revenue is primarily a function of growth in business volume and changes in the take-up rate. As mentioned above, business volume has grown 8-9% per annum over the last 5-10 years, and a rising take-up rate has contributed 2-4 percentage points to annual growth. Operating revenue organic growth has averaged 11-12% over the last 5-10 years. The table below shows Edenred’s operating revenue organic growth by geographic segment and payment solution for the last several years. Assuming the take-up rate does not continue to increase, organic growth for B&E and Mobility should trend toward growth in business volume. Organic growth in Complementary Solutions will be largely driven by Corporate Payment Solutions over time, which should grow by at least a mid-teens percent for the next several years.

Float Income: Float income is a function of prepaid business volume (“float”) and interest rates. The float largely comes from B&E clients, but also some Mobility clients that use prepaid cards. For these clients, Edenred receives the funds to be redeemed by their employees and then pays merchants where the funds are used about 7 weeks later. It invests the float in low-risk financial securities to earn interest income during those 7 weeks. Float is not transferred between countries or currencies. It grows with the number of users (employees) and with the amount contributed per user. Over time, growth in the float should roughly correspond with growth in business volume for the relevant payment solutions. This will be below the growth in Edenred’s overall business volume, as non-regulated and non-prepaid solutions increase as a percentage of the business. Float has grown 6-7% per annum over the last 5-10 years.

From a balance sheet perspective, funds to be redeemed (liability) correspond to the outstanding business volume. A portion of these funds have not yet been received from the corporate client and are recorded within trade receivables (asset). Another portion is held as restricted cash (asset), as some countries regulate what can be done with prepaid business volume. Other countries allow Edenred to hold the funds as regular cash. There are no restrictions or obligations for prepaid business volume in these countries, so long as Edenred pays the corresponding obligation when due. Float is the funds to be redeemed that are held as restricted cash and regular cash. The chart below shows the average annual float, along with the split between restricted cash and regular cash. Regular cash related to the float was ~€2b at the end of H1 2024.

The float liability does not bear a financial charge, and the regular cash associated with it is available for Edenred to use as it sees fit so long as business volume does not shrink. If business volume does not shrink, the redemption of contributions made today can be paid with contributions made in T+7 weeks. Consequently, regular cash related to the float can be used to meet financial liabilities or fund acquisitions. This cash should not be considered “free cash” in an enterprise valuation, however, because its value is already being reflected in float income.

Where the float is located plays a big role in float income due to the differences in interest rates around the world. Edenred does not disclose float by country, but it does disclose restricted cash by country. (It did disclose that 80% of the float at the end of 2021 was in Europe and 15% was in Latin America.) In recent years, 85-90% of restricted cash is in France (~40%), the UK (~30%), Belgium (~12.5%), and Romania (~6%). As Edenred’s business has shifted toward Europe and away from Latin America over the last decade, restricted cash has become a greater percentage of the float (as shown in the chart above). Europe has also accounted for a greater percentage of float income in recent years, especially with the rise in interest rates in Europe over the last two years.

Float income has increased significantly in the last two years due to the rapid increase in interest rates, particularly in Europe. Interest rates have started to decline in Europe but remain well above pre-covid levels. The average float should continue to increase over time as the B&E segment continues to grow, which should partially offset the interest rate headwinds.

Operating Profit: Edenred is largely a fixed cost business with low capital intensity and high free cash flow generation. Transitioning more of the business volume to digital over the last several years—rising from 70% in 2016 to 94% in 2023—further increased operating leverage. Organic growth should therefore drive operating margins higher over time.

Some of the expected positive operating leverage in recent years has been offset by significant growth in technology investments. Edenred’s technology investments, included in both operating expenses and capex, nearly doubled from ~€250m in 2019 to ~€480m in 2023. Consequently, other operating expenses and D&A expense as a percentage of sales increased from 24.6% in 2018 to 28.7% in 2023. The consolidated EBIT margin excluding float income has therefore remained flat over the last several years despite double digit organic growth on average. These investments should strengthen Edenred’s competitive position and set the stage for continued strong organic growth in the years to come.

Operating margins in Europe have increased more than 13 percentage points in the last decade, excluding float income, driven by strong organic growth and digitalization. Latin America has seen the opposite trend, as once important countries such as Venezuela and Argentina have dwindled to nearly nothing, and significant investments have been made in the technology infrastructure in rapidly growing countries in the region such as Mexico. The EBIT margin excluding float income in Latin America should reverse its trend in the coming periods as continued strong organic growth leverages the investments made in recent years.

Free Cash Flow: Edenred’s free cash flow is more complex than that of a standard company, so it’s worth walking through the calculation step by step.

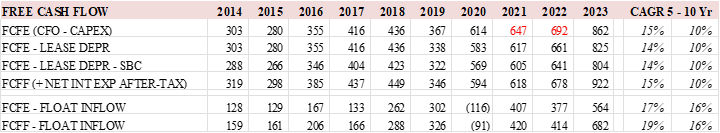

The basic FCFE (free cash flow to equity) measurement is cash flow from operations less capex. This is shown in the top line of the table below. (There are two significant one-time items that I adjust for in 2021 and 2022.) Cash lease payments are included in the cash flow statement line “change in current debt net of change in short-term investments” and are not explicitly broken out. I deduct lease depreciation as a proxy for the cash lease payment. This is shown in the second line of the table below. Edenred also regularly issues stock based compensation to its employees and then repurchases shares to offset the dilution. FCFE less SBC expense is shown in the third line of the table below. The fourth line adds net interest expense after-tax to get FCFF (free cash flow to the firm). These are all standard calculations to get economic FCF.

The tricky part concerns how regular cash related to the float is accounted for on the cash flow statement. Since part of the float is held as regular cash, when that part of the float increases it is considered a cash inflow in CFO. As described above, this cash is available for Edenred to use as it sees fit so long as business volume does not shrink. From one perspective, then, it makes sense to consider this as FCF. However, a conservative approach would exclude this cash inflow from FCF to get the FCF that is available under any circumstance. This conservative FCF metric is shown at the bottom of the table above.

Edenred generates significant FCF using any calculation method in the table above, and FCFF conversion (% of EBITDA) is also solid (see chart below). However, including/excluding the float inflow from FCF paints materially different pictures. FCFF excluding the float inflow has grown 16-19% per annum over the last 5-10 years, implying the core Edenred business is significantly improving.

Return on Invested Capital: Edenred’s ROIC has ranged from 30-40% for most of the last decade. It was trending down prior to the appointment of Bertrand Dumazy in late 2015, but reversed course shortly thereafter. ROIC declined meaningfully in 2023 (to 32%) due to an acquisition during the year. The acquisition increased average invested capital by nearly 50%, but it will take a few years for the acquisition’s benefits to be fully reflected in earnings. Importantly, the high ROIC is not due to the float income. Excluding float income from EBITA (without also excluding the float from invested capital), ROIC would still range from 20-30% since the IPO.

The return on incremental invested capital over the last several years has averaged ~25%, again with the recent return weighed down by invested capital that is not yet fully reflected in earnings. The return on incremental invested capital through 2022 was >35%.

Balance Sheet Quality (H1 2024): Edenred has €5.0b in debt and €3.2b in cash and cash equivalents; net debt of €1.8b is 1.5x LTM EBITDA. Excluding the €2b of regular cash related to the float, net debt is ~€3.8b and equal to ~3.2x LTM EBITDA. The float liability does not bear a financial charge, and the regular cash associated with it is available for Edenred to use as it sees fit so long as business volume does not shrink. If business volume does not shrink, the redemption of contributions made today can be paid with contributions made in T+7 weeks. Consequently, regular cash related to the float can be used to meet financial liabilities or fund acquisitions. Therefore, 3.2x net leverage for Edenred is significantly less risky than it would be for another business without a float. Edenred’s debt maturity schedule (shown below) is easily manageable considering the cash on hand and FCF generation. I view Edenred’s balance sheet quality as high.

Management Quality: Chairman & CEO Bertrand Dumazy (currently 52 years old) was appointed in 2015, along with Patrick Bataillard as CFO. These two led Edenred’s digitalization and diversification, allocating capital into a variety of bolt-on acquisitions that expanded Edenred’s services and geographic presence. Their efforts resulted in accelerating like-for-like growth and a steadily expanding EBITA margin. Bataillard left the company to start a consulting firm at the end of 2020. Julien Tanguy was promoted to CFO in January 2021. He joined Edenred in 2011 as CFO of Edenred France and was appointed CEO of the same division in 2016.

Dumazy owned ~86k Edenred shares at the end of 2023 (~€2.6m market value).

Long-term compensation is awarded through performance shares. Performance shares are based on the following metrics over three consecutive years and have a three-year vesting period: 50% for LFL growth in EBITDA versus annual guidance, 25% for TSR versus the average TSR for companies included in the SBF 120 index, and 25% for CSR criteria. Executives are therefore relatively aligned with long-term shareholders.

Capital Allocation: The dividend per share has increased over the last few years from €0.70 per share in 2019 to €1.10 per share in 2023. M&A is core to Edenred’s strategy. Overall, Edenred has a strategically and financially sound acquisition process that creates long-term shareholder value. It focuses on bolt-on acquisitions for B&E that expand the services offered, and geographic/service expansion acquisitions for Mobility. Finally, Edenred launched a €300m buyback program in early 2024.

Overall, I believe Edenred’s management is high quality, with a solid capital allocation record. For additional capital allocation details see my follow-up post here: Edenred Follow-up: FCF Allocation.

Valuation: Edenred is targeting >12% LFL annual EBITDA growth for 2024 and 2025. Management has consistently met or exceeded financial targets since taking over in 2015, except for in 2020 (due to covid). EBITDA growth in H1 2024 was +24% and +18% excluding float income. Management guided for a slight deceleration in EBITDA growth excluding float income in H2 2024 to +12%. Foreign currency depreciation (specifically the BRL) will be a headwind for reported results. Additionally, declining interest rates could be a headwind in Q4 2024 and throughout 2025.

With the recently proposed regulation change in Italy, management updated its EBITDA target for 2025. It expects at least 10% EBITDA growth in 2025 if the 5% cap on merchant fees is approved in Italy and at least 12% EBITDA growth if the cap is not approved. A 5% cap on merchant fees in Italy could reduce EBITDA by €60m in 2025 and €60m in 2026. If management achieves its EBITDA targets for 2024 and 2025 (10% growth) and the current EV/LTM EBITDA multiple of ~10x does not change, the share price should reach ~€37.5 at the end of 2025 (+26%). This includes estimated FCFE generated in 2025 (excluding float inflow) of ~€2.8 per share. If EBITDA growth declines to +6% in the years after 2025 and the EV/LTM EBITDA multiple remains constant, the share price should rise by 10-15% per annum. I believe a conservative estimate of market growth for Edenred’s payment solutions is ~6% given the penetration rates. Growing EBITDA 6% would mean Edenred just maintains market share and does not experience any operating leverage from the investments made over the last several years. I believe this is a conservative scenario.

Edenred trades at ~14.5x P / LTM normalized EPS and ~15x EV/ LTM FCFF (~7% EV yield; ex-float related cash inflow). FCFF has grown 19% per annum over the last five years, while organic revenue growth has averaged 13% over the same period. Management expects EBITDA to continue growing at a double-digit rate for years to come. Even at half of that growth rate, though, the prospective multi-year equity IRR at the current valuation is in the low teens (assuming a stable EV multiple). A multi-year IRR in the low teens is attractive considering Edenred’s business quality. Historical transaction multiples for payment companies (16-22x EBITDA) also support the view that Edenred is materially undervalued—the shares trade for <10x 2024E EBITDA.

From a relative valuation perspective, Edenred trades at the lowest forward P/E multiple in its history (see chart below). The only other time its shares traded anywhere near this valuation was late 2015, when Latin America was a much larger piece of the business and various countries in the region were experiencing currency issues. In the ten years prior to 2024, Edenred’s forward P/E multiple was, on average, a ~44% premium versus the S&P 500. It traded at a multiple discount versus the S&P 500 on just 9 trading days during those 10 years. Edenred has traded at a lower forward P/E multiple than the S&P 500 on over 60% of the trading days in 2024.

Misc Notes for Financial Statements:

In 2023, Edenred paid a €155m fine that reduced net income. A provision for the fine was recorded in 2021, reducing CFO via lower working capital that year.

In 2022, a change in Germany regulations caused a one-time working capital benefit of €170m, thereby increasing CFO.

In 2019, a one-time working capital issue in Mexico led to a working capital use of cash for the year.

Transitioning from paper to digital vouchers shrank the float, and therefore working capital, by shortening the period between issuance and redemption. This process was largely complete by 2022.

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.