The purpose of this blog is to share my research with a wider community, in hopes of receiving constructive feedback and bringing greater awareness to what I believe are attractive investment opportunities. I appreciate any and all constructive feedback and pushback on my posts and ideas. I usually own shares, at the time of writing, of companies discussed on this blog. To review my investment philosophy and the structure for each post see my introductory post here: Patches AKF Intro. Nothing I write should be considered investment advice. Please share and invite others to subscribe if you find these posts valuable.

This is a follow up to my first Edenred post in June 2024, which can be read here: Edenred SE. It focuses on Edenred’s acquisition history and strategy.

September 11, 2024

Considering Edenred’s significant free cash flow and limited opportunities for additional reinvestment – capex is already >7% of sales – FCF allocation will be a significant determinant of the value realized by shareholders over the long term. Edenred does return cash to shareholders through a dividend (paid ~€270m or €1.10 per share for 2023) and share repurchases (announced a €300m buyback program in early 2024; has spent ~€230m in 2024 through August), >100% of FCFF (ex-float inflow) has gone toward M&A over the last five and ten years. Below is an overview of Edenred’s acquisition history and strategy.

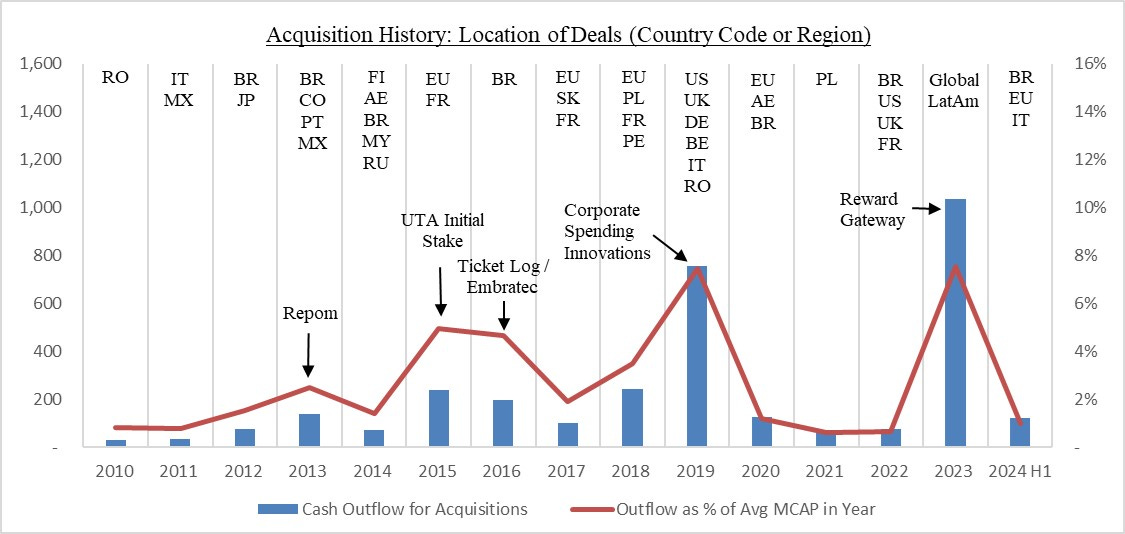

Acquisitions: Since listing in 2010, Edenred has spent ~€3.3b in cash on more than 30 acquisitions. The chart below shows the annual cash outflow for acquisitions and that outflow as a percentage of Edenred’s average market cap for the year. Most deals were relatively immaterial; only the five acquisitions named in the chart were significant and are discussed below. The chart also shows the country codes (or regions for multi-country businesses) of deals completed each year. Bertrand Dumazy (appointed Chairman and CEO in October 2015) has overseen most of Edenred’s acquisitions, with ~€2.7b spent on acquisitions since the beginning of 2016. Impressively, goodwill impairments have totaled just €20m since 2015, <1% of the cash outflow for acquisitions.

Acquisitions have primarily bolstered Edenred’s offering in its two largest segments, Benefits & Engagement (was Employee Benefits) and Mobility (was Fleet & Mobility). There is one notable exception: Corporate Spending Innovation in 2019 (discussed below). Importantly, most of Edenred’s acquisitions in the last several years have reduced its dependency on and exposure to regulation. In 2023, over 55% of operating revenue was not dependent on regulations, a percentage that should continue to increase in the coming years. Management explained the current M&A strategy at the capital markets day in October 2022. The key priorities for each business segment are stated in the image below, along with the key criteria businesses must have to be acquired.

Edenred has been disciplined regarding the strategic logic of acquisitions and the price paid. Notably, it was relatively inactive during the frothy years of 2020 and 2021, when acquisition multiples for payment companies (and everything else) were elevated. Dumazy explained this inactivity at the capital markets day in October 2022:

“Why didn't we do many things during those years [2019 to 2022]? First of all, the multiples were super high. And the second thing is we are super pragmatic people. When some assets are on the market, but we cannot spend some time due to COVID with the management team, when what is being sold is a black box…saying, ‘You know what, it's super expensive and it's a black box, but…it's high-quality stuff.’ We don't believe in that. We love looking at what is inside the box, the quality of the people, the management team, the quality of the technological platform and the quality of the client portfolio. If we are not able to have a judgment on that, we don't believe anybody. So, at Edenred, in God we trust, but everybody else must bring data. So, we can stay super disciplined if needed because, once again, we have years in front of us of growth based on the underpenetrated market and the platform that is delivering more and more. So, we will keep that discipline…”

Dumazy not only talks intelligently about capital allocation, but Edenred’s actions (and inactions) support his talk. With Dumazy just 53 years old, Edenred’s shareholders should be in good hands for many years to come.

Five noteworthy deals: Repom, UTA, Ticket Log / Embratec, Corporate Spending Innovations, and Reward Gateway

Edenred acquired 62% of Repom for €53m in early 2013. While this was a small deal from a monetary perspective, it was strategically important. Repom was the leader of Brazil’s expense management solutions for independent truckers. Its preloaded cards covered all independent trucker expenses, including fuel, meals, tolls, and wages. Repom complimented Edenred’s existing integrated fleet management solutions, creating the only provider in Brazil that covered all segments of the road transportation sector. The combined scale (client and merchant network, along with local sales force) was a significant advantage in driving subsequent growth.

In 2015, Edenred acquired a 34% stake in Union Tank Eckstein (UTA) for ~€150m at a valuation of ~14x net income. The deal included a variety of call/put options that led to Edenred owning 51% in early 2017, 83% in early 2018, and 100% in early 2020. Over the years, Edenred paid >€450m at a mid-to-high teens multiple of net income to acquire UTA. UTA was (and still is) a leading provider of expense management solutions (such as fuel cards, tolls, maintenance, VAT reimbursement, etc.) for heavy vehicles in Europe. It had >60k clients and a network of >34k service stations across 40 European countries in 2015.

Edenred has expanded, both organically and inorganically, UTA’s solutions offered, fleet segments supported, client network, merchant network, and countries of operations. Scale increases the attractiveness of joining a network for both clients and merchants, in addition to creating greater synergy potential for bolt-on acquisitions. Building this scale organically, as opposed to the acquisition of UTA, would have been extremely difficult for Edenred. In 2023, UTA had ~90k clients and a network of >65k service stations, with services other than fuel cards accounting for >40% of revenue. Edenred is now the #4 mobility solutions provider in Europe, with 2 of the top 3 being oil companies and the other being DKV, a family-controlled entity that Edenred has expressed interest in acquiring. (DKV was exploring an IPO in 2023 but decided against it due to market conditions.)

Ticket Log is a JV formed in 2016 through the combination of Edenred’s Brazilian expense management assets (including Repom) with those of Embratec. Embratec provided fuel cards and maintenance solutions to ~15k clients and had a network of ~19k service stations across Brazil. It also had a small employee benefits business that Edenred acquired separately (included in the price paid). Ownership of the JV was split 65/35 between Edenred and Embratec, with the latter also receiving a cash payment of ~€180m. Edenred put the transaction multiple at ~14x EBITDA including synergies. The deal nearly doubled Edenred’s fuel card business in Brazil, increasing its market share to ~18% and making it the #1 provider for light vehicles and the #2 provider for heavy vehicles. The combined scale (client and merchant network, along with local sales force) has been a significant advantage in driving subsequent growth. Edenred’s Mobility revenue in Brazil has more than tripled in local currency since 2014 (proforma 2014 to include Embratec). Edenred is currently the largest mobility solutions provider in Latin America.

The ~$600m acquisition of Corporate Spending Innovations (CSI) was announced in November 2018 and completed in early 2019. CSI provides corporate payment solutions (CPS) in the US and Canada. It made $43m in revenue and $26m in EBITDA in 2018, implying an acquisition multiple of ~23x EBITDA. On a relative basis, the multiple is at the high end of multiples paid for CPS companies pre-covid. Potential synergies were limited to eventually deploying the acquired solutions in Europe, as Edenred did not have a meaningful presence in the US or Canada prior to acquiring CSI.

Edenred entered CPS in 2016 through a partnership with CSI in Europe. CPS is meant to be Edenred’s third growth engine, alongside B&E and Mobility. Business-to-business payments are still dominated by cash and check, indicating a significant organic growth opportunity for digital solutions. CSI grew revenue by a double-digit percentage for several years before being acquired, and it was expected to grow 20% per annum for a few years after the deal. However, CSI’s core business verticals are media, hospitality, and sports and events. The latter two verticals were hit hard during covid, and traditional media companies are increasingly challenged. Consequently, revenue growth post-acquisition has underperformed Edenred’s expectations. CSI has still averaged double digit growth, however, and CPS operating revenue was ~€100m in 2022.

CPS has common business model characteristics with B&E and Mobility: revenue is recurring, operations are scalable, creating a network of customers and suppliers that accept the payment solution is difficult, disrupting an established network of customers and suppliers is difficult, and cash conversion is high. There are differences as well, though, such as the key decision maker being a CFO rather than an HR or fleet manager, the users being businesses rather than consumers, and the high industry fragmentation. Building initial scale through an acquisition was probably the logical path to entering the segment, given the difficulty of establishing a sizable network. However, it is not a given that Edenred’s expansion into CPS was itself logical or that it will be successful (versus expectations). That said, at just 5% of Edenred’s average market cap during 2019 and ~1.5x 2019 FCF, CSI was not a bet the company acquisition. Edenred has only made one subsequent CPS acquisition, a small invoice automation vendor in 2022 that had been collaborating with CSI since 2015. Emphasis seems to be on organic growth for the time being, as management has noted that multiples for CPS businesses are extremely high.

Edenred acquired Reward Gateway, a leading employee engagement platform, from private equity in May 2023 for £1.15b (~20x 2023E EBITDA). Reward Gateway is the market leader in the UK (68% of revenue) and Australia (20%) and is present in the US (12%), with >4k clients and >8m employees using its solutions. Reward Gateway was expected to generate ~£95m of revenue and ~£45m of EBITDA in 2023, with ~80% of revenue coming through a SaaS fee model. Edenred expected cost synergies to exceed €10m in both 2024 and 2025; >80% of total synergies were already delivered by H1 2024.

Engagement products – employee savings, reward and recognition, communications, surveys, and well-being solutions – give HR managers the tools to engage, motivate and retain employees. These solutions are a natural cross-sell opportunity for meal and food vouchers, with the decision maker for both being the HR manager. Providing multiple employee benefit solutions reduces client churn and increases fees. Employee engagement products are typically not supported by regulations. Instead, the provider leverages its user scale to negotiate merchant discounts (like mobility solutions), or it simply provides a low cost valuable service for the employer (the client). Scale, particularly local scale, is a significant competitive advantage.

Many of Edenred’s acquisitions over the last several years were employee engagement providers in countries where it already has a strong (typically #1) meal and food voucher business. Before acquiring Reward Gateway, Edenred offered employee engagement solutions in 17 countries. It was a top 3 player in the UK, #1 in France, #1 in Italy, #1 in Germany, and #1 in Romania. Shortly after acquiring Reward Gateway, Edenred acquired GOintegro, an employee engagement platform in Latin America with >1.2m users. Acquiring saves Edenred the hassle of building the local user scale and merchant network necessary to offer these benefits. Edenred can then offer the acquired solutions to its local clients for minimal incremental cost. Acquiring Reward Gateway also gave Edenred a quality technology platform and an experienced management team to run the business – management staying was an important condition for Edenred.

Reward Gateway was capital constrained under private equity ownership. After the deal closed, Edenred immediately began expanding the platform to additional European countries. Reward Gateway was launched in France, Belgium, and Italy in Q2 2024 and is expected to launch in four more European countries by the end of 2024. Edenred expected geographic expansion to increase annual operating revenue by least €50m within 5 years.

Summary view on deals: Overall, I view Edenred’s acquisition history favorably. Acquisitions have been strategic, and prices were generally reasonable. Importantly, most of Edenred’s acquisitions in the last several years have reduced its dependency on and exposure to regulation. In 2023, over 55% of operating revenue was not dependent on regulations, a percentage that should continue to increase in the coming years. CSI was the only deal outside of Edenred’s existing segments. The multiple paid for CSI was high from an absolute perspective, but an acquisition was probably necessary to enter CPS and have a chance at success given the network requirements. CSI gives Edenred a CPS network from which it can drive organic growth and make bolt-on acquisitions. Expanding into CPS reduced Edenred’s dependency on and exposure to regulation, and the organic growth of CPS should further reduce this dependency for years to come.

Incremental Return on Invested Capital: Edenred’s ROIC has ranged from 30-40% for most of the last decade. It dipped toward the low-end of that range (32%) in 2023 due to the acquisition of Reward Gateway. Reward Gateway only contributed for ~7 months in 2023, and synergies from the acquisition (cost related and footprint expansion) will not be fully realized for a few years. The return on incremental invested capital over the last several years has averaged ~25%, again with the recent return weighed down by invested capital that is not yet fully reflected in earnings. The return on incremental invested capital through 2022 was >35%.

Chairman & CEO: Bertrand Dumazy (currently 53 years old) was appointed Chairman and CEO in October 2015, following the resignation of Jacques Stern earlier that year. Stern led the company from its demerger with Accor in 2010. Dumazy began his career as a consultant at Bain & Company, joined BC Partners (PE firm) in 1999, Neopost Group in 2002, Deutsch in 2011, and Cromology in 2012. Starting as head of Marketing and Strategy at Neopost Group, which specializes in mail handling and digital communication solutions, he rose to Chairman and CEO of Neopost France and then CFO of Neopost Group by 2008. Dumazy’s tenure as CEO and Chairman of Deutsch was cut short when the group was acquired by TE Connectivity. He served as CEO and Chairman of Cromology, a global player in the decorative paint sector, before joining Edenred. Dumazy owned ~86k Edenred shares at the end of 2023 (>€3m).

Board of Directors: There are 12 directors, including Dumazy, 2 employee representatives, and 9 independent directors. Directors have a good mix of tenure, with 7 serving for less than 5 years and just 2 serving for more than 10 years. Interestingly, the two longest serving directors are also two of the youngest directors. The experience and expertise of the board seems to be a good fit for Edenred, covering technology, HR services, cyber security, M&A, finance, France, Italy, Spain, and Brazil. Information on the more noteworthy directors is detailed below.

Jean-Romain Lhomme (48 years old) joined the board in 2013. He served as Principal and Co-Head of Colony Capital Europe from 2000 to 2015. He has since served as Managing Director of Lake Partners, a VC fund focused on Europe.

Maëlle Gavet (45 years old) joined the board in 2014. She served as a Principal at Boston Consulting Group for 6 years, CEO of OZON.ru for 4 years, EVP Operations at Priceline Group for a year, and COO of Compass (NY-based residential brokerage backed by Softbank) for 3 years.

Sylvia Coutinho (Brazilian) joined the board in 2016. She currently serves as the Head of Wealth Management Latin America and Country Head Brazil at UBS Group.

Angeles Garcia-Poveda joined the board in 2021. She worked at Boston Consulting Group for 16 years and Spencer Stuart, the global executive search and leadership consulting firm, for 15 years. She has also served as Chairwoman of Legrand since July 2020.

Philippe Vallée joined the board in 2021. He was the CEO of Gemalto, a global leader in digital security, before it was acquired by Thales. He now serves as EVP Digital Identity & Security GBU at Thales.

Monica Mondardini (Italian) joined the board in 2021. She has served as CEO of the Italian holding company CIR Group since 2012.

Bernardo Sanchez Incera joined the board in 2022. He has served as Deputy CEO of Société Générale since 2010.

Disclosure: I usually own shares, at the time of writing, of companies discussed on this blog. I write the articles myself; expressing my own opinions. I have no business relationship with any company mentioned on this blog. There are no plans to provide updates on my buying or selling activities for each stock. I may buy or sell shares of the companies discussed on this blog without notice for any reason at any time.

Disclaimer: All information on this site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Because the information is based on my opinion and experience, it should not be considered professional financial investment advice. These ideas should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will change from time to time as I learn and accumulate more information. I am under no obligation to publically update my thoughts and opinions.

I think reward gateway was not a cheap deal and given the current market conditions I'm glad that management changed priorities to small bolt ons instead of large deals. A deal at 20x EBITDA while Edenred trades at 6x would make me seriously question management right now. For quite a few investors I talked to, M&A discipline is a potential bear case.